Social development issues are becoming increasingly important in our country in the light of tragic events in January 2022

How our society, investors, companies and business can benefit from social involvement and social responsibility? What are the goals of social organizations? What are the tax benefits for the social organizations?

Baker Tilly consultants would like to attempt to reply to those questions in this article.

The social sphere refers to all sectors that aim to serve basic social needs of the population: education for children and adults, medical care, culture and sport, socialization of young people.

Article 290 of the Tax Code also specifies the conditions and notes under which these activities can be attributed to the social sphere, for example, medical care services and educational services (from primary to postgraduate) in the presence of appropriate licenses, etc.

What does the classification of universities, medical centers, research organizations, etc. as organizations of the social sphere mean?

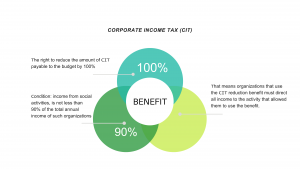

First, the right to have the amount of corporate income tax (CIT) payable to the budget reduced by 100 percent. Well, that this is a good enough benefit.

This benefit is available for organizations engaged in social activities, if income is solely received from the social activities (listed above). Taking into account that the free income in the form sponsorship or charity, remuneration on deposits, as well as the excess of the amount of positive exchange rate difference over the amount of negative exchange rate difference arising on such income, is at least 90% of the total annual income of such organizations.

For example, universities, in addition to their main educational activities, may have additional profitable activities. Analysis of the charters of major universities in the country showed that in addition to educational activities, they could engage in consulting business, the provision of engineering, construction and installation, design and other works and services. If the income from such activities exceeds the income from educational activities by more than 10%, the university will automatically lose the right to use this benefit.

In addition, an important condition of this benefit is that the income of social organizations is not subject to taxation when directed to the implementation of these activities.

Let us analyze this norm in detail. Social organizations that use the CIT reduction benefit must allocate all income to the activity that allowed them to use the benefit.

What does this mean in practice? For example, many of the founders of such organizations will not be able to claim a profit because, due to diverted dividend income, the organization will lose the right to the CIT reduction.

Well-known lawsuits, which began 3 years ago, showed that many companies – well-known medical centers, universities, etc., actively used this privilege and at the same time paid dividends to their investors.

This position of the state authorities seems both logical and comprehensible from the point of view of ultimate purpose of the social organization is not the profit making, but the serving people’s needs.

The initiative of the Ministry of Education and Science to transform universities into non-profit joint-stock companies (NJSC) looks also logical here. Recall that a non-profit organization is a legal entity that does not have as its main purpose the generation of income and therefore, it does not distribute the net income received between the shareholders. The program of transformation of universities touched not only public, but also private universities. For example, “Al-Farabi Kazakh National University” transformed into the non-public joint stock organization in 2020, and one of the famous private universities “Narxoz University” transformed in 2019.

Thus, the government clearly appeal that only social organization may use the right to reduce CIT by 100%, if the income in this area is not less than 90% and otherwise the income is spent for further expansion of social activities.

In addition to Article 290, the Tax Code contains many references and notes concerning the taxation of the social organizations. We also decided to go into more detail on the specifics of the property tax for such organizations (Section 15 of the Tax Code).

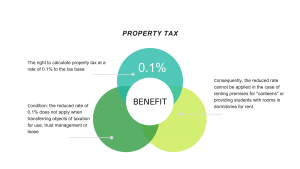

It generally established that organizations calculate property tax at the rate of 1.5 percent to the taxable base. However, the social organization in particular are prompted to apply lowered rate of the property tax of only 0.1 percent to the tax base: That is, such organizations are entitled to reduce the property tax by 15 times!

There are again certain conditions to use this tax benefit; namely, the rate of 0.1 percent to the tax base cannot be applied when transferring objects of taxation for commercial use, trust management or lease.

We would like to note that in practice many organizations have also encountered problems in applying this particular clause when calculating property tax.

For example, the educational organizations also provide food for students; provide dormitories, etc. These conditions created by many universities by the renting space for «student canteens” or renting rooms in dormitories to students. There are many examples in the judicial base, when the tax authorities assessed additional property tax on the rental of premises, even if this amount was only 2% of the area of all objects of taxation for the last 5 years. The amounts of lawsuit claims look impressive.

This situation could be resolved by amending the Tax Code, to allow the social organizations to calculate the property tax based on the share of these objects of taxation, transferred for use, trust management or lease at a rate of 1.5%, and to the remaining share of taxation to apply a rate of 0.1%.

We hope that our analysis of some of the taxation conditions for facilities operating in the social sphere has been useful and interesting for you!

Baker Tilly’s tax and legal advisory team has extensive experience in providing services to social service entities. The information contained in this article is general and not to be used as legal advice. If you have any questions about the information in this article, please do not hesitate to contact us-we will be happy to discuss them with you.

Togzhan Aytmukhametkyzy, Director of AIFC Branch of Baker Tilly Qazaqstan Advisory LLP