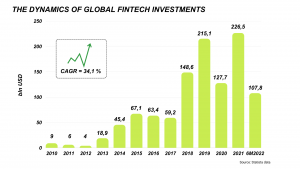

Over the past few years, the financial technology sector gained traction amid investors, as reflected in the substantial investments in projects of this area – $226 bln (+75% YoY), according to tadviser. Vastly this trend has been accelerated by the pandemic of 2020 when the need for digitalization has affected many industries to meet customer needs.

Venture capital emerged as the primary source of financing for FinTech projects, generating 4,700 deals totaling $115 bln (84% of all FinTech deals in 2021) globally. On the other hand, corporate investments amounted to $83 bln (820 deals), and private equity funded 140 deals totaling $12 bln.

Digital Payments, Financial Cybersecurity, and InsurTech turned out to be the most in-demand areas, whereas USA, UK, and Singapore ranked as the countries with the highest level of fintech market development.

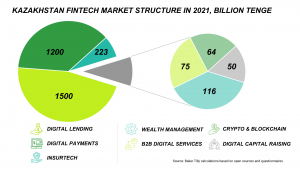

Meanwhile, the financial technology market in Kazakhstan is actively developing, primarily in the payments and lending areas. Yet, most market segments are still in the early stages of growth. According to AIFC, FinTech has become the third most preferred sector in terms of attracted capital on the AIFC platform in 2021.

We believe that Fintech in Kazakhstan is one of the most promising industries. Geographical position grants an opportunity to consider Kazakhstan as a potential regional hub in Central Asia. Ranking 15th in the world by the level of digitalization, our country possesses all features for the pro-active growth of the fintech market. Current geopolitical uncertainty in the region creates risks and opportunities for the sector’s development. Meanwhile, the growth pace of the fintech market and the startup industry, in general, is limited by low transparency and the limited number of venture investors, most notably in the second and third rounds. Efforts to develop these aspects are being actively worked on by both AIFC and the market players.

Regulation of the financial sector remains relatively rigid, leading to the dependence of sector players on banks in terms of money holding, e-money emission, and, in many cases, personal data. There are already cases across Europe of fintech market players obtaining banking licenses to reduce the chain of intermediaries and enhance the economics of products. Similar phenomena may eventually affect the Kazakhstan market, with big fintech market players replacing traditional banks exiting the business due to sector consolidation, assuming sufficient financial capabilities.

The benchmark of fintech development in Kazakhstan is the payments segment, with about 78% share of cashless retail payments. Due to the rapid growth of P2P transfers, the percentage of local payment systems has reached 85%. As of 2022, the trend of stricter regulation of payments between individuals and the state’s initiative to transition to a single form of QR payments, facilitating the growth of competition, has been noted.

The benchmark of fintech development in Kazakhstan is the digital payments segment, with about 78% share of cashless retail payments. Due to the rapid growth of P2P transfers, the percentage of local payment systems has reached 85%. As of 2022, the trend of stricter regulation of payments between individuals and the state’s initiative to transition to a single form of QR payments, facilitating the growth of competition, has been noted.

The rapid growth of BNPL (+40% YoY in 6M2022) and the development of new credit products, such as factoring and P2P lending, are noted in the digital lending segment. The ongoing debates on further reduction of maximum rates of online loans might lead to the transition of some MFIs to bank status in an attempt to improve the funding framework to maintain business profitability.

In the insurance market, the digitalization process resulted in the emergence of insurance subscriptions based on regular online subscription. Besides, there is a high rate of life insurance growth and the emergence of new products like policies for specific diseases and co-insurance.

In its turn, the wealth management segment demonstrates double-digit growth in the number of retail investors YoY, caused by the introduction of fintech solutions leading to simplification of investing for retail investors and transition of brokers to an online format. The development of crowdfunding and crowdlending is at an early stage, as scaling such business models is only possible as investment culture develops.

Since the beginning of the partnership of MFCA with crypto-market giants Binance and ByBit, and the potential introduction of a crypto-card, the growth of the crypto segment might gain traction considering the popularity of cryptocurrency mining in Kazakhstan.

The GovTech field in Kazakhstan facilitates the advancement of fintech services due to the policy of accessible government services and the availability of integration with third-party services.

The fiscalization of SMEs has triggered the evolution of digital B2B services, the most diversified segment, including digital ID services, accounting and tax outsourcing, and more. Rising numbers of individual entrepreneurs and the e-commerce market contribute to the growth of accounting outsourcing services.

Based on the study results, we consider fintech a promising area for Kazakhstan, given the presence of regionally competitive players in the payment and lending segments. Meanwhile, the regulator’s initiatives are aimed at enhancing competition in these sectors. Analysis of the composition of participants by market segment indicates the ongoing trend of transition to ecosystems, when participants try to combine various services in a single app, creating hybrid services. Aspiration for the ecosystem, product development, and opportunities of AIFC, along with the gradual formation of the venture capital market, could accelerate the development of other areas of financial technology.

Based on the study results, we consider fintech a promising area for Kazakhstan, given the presence of regionally competitive players in the payment and lending segments. Meanwhile, the regulator’s initiatives are aimed at enhancing competition in these sectors. Analysis of the composition of participants by market segment indicates the ongoing trend of transition to ecosystems, when participants try to combine various services in a single app, creating hybrid services. Desire to form ecosystems, product development, and opportunities of AIFC, along with the gradual formation of the venture capital market, might give a chance to accelerate the development of other areas of financial technology.

IoT and Big Data, process automation, cost reduction, and convenience of using fintech products promote market transparency, giving investors additional opportunities to develop existing products and add new ones to their portfolios.

Since a substantial part of fintech projects outside the payment and credit sectors are start-ups, the right approach to implementation and the entry of committed investors (perhaps represented by existing market players) will bring Kazakhstan closer to the role of Central Asia’s technology hub. The coming years will show whether the players embrace the opportunity of introducing new phenomena capable of revolutionizing Kazakhstan’s financial sector.