What Kazakhstan tax law changes are coming for foreign companies in 2023?

Starting 1 January 2023, Kazakhstan Tax Code has introduced several amendments that might affect business with foreign investments.

Over the last decade, Kazakhstan has been a prominent Central Asian leader in attracting foreign investors; there has been absolute dominance of the Kazakhstani destination among the investor countries with a 100 % FDI index to Kazakhstan only. 2022 also brought a significant FDIs inflow of $28bn into Kazakhstan’s economy, which is 17.7% higher than the 2021 results ($23.8bn). According to a statement on Prime Minister Mr. Smailov’s website, “This is a record figure for the last 10 years”. This leadership position stands on various grounds, one of which is definitely the most favorable tax regime for foreign investors and the overall stability and transparency of the tax legislation.

Globally, the year 2022 marks a tectonic shift in international relations when we are witnessing global changes that bring both new challenges and new opportunities for Kazakhstan. In the context of political and economic turbulence globally, one of the challenges for Kazakhstan is to maintain its current status as an FDI leader by providing the most favorable tax regime for foreign investors.

From 1 January 2023, there are a number of changes to Kazakhstan Tax law that might affect foreign investors. Some of the changes are more “obvious” and can be immediately “assessed” for their impact on business, and some are seemingly insignificant, but at a closer look, the changes might have a massive effect on the industry.

One of the changes to the Tax Code that may affect foreign investors are reflected in the following articles of the Kazakhstan Tax Code:

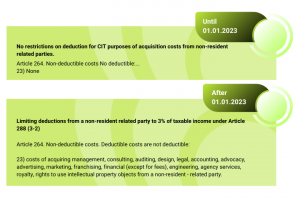

- Changes were made to Article 264 of the Kazakhstan Tax Code, which was amended with paragraph 23, previously absent in the previous 2022 version of the Tax Code; in particular, Corporate Income Tax deductions for expenses from the non-resident/related party are now limited to only 3% of the taxable income under Article 288.3-2

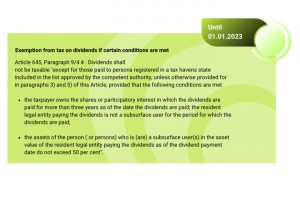

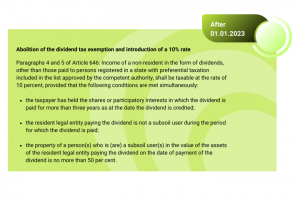

- Article 645 – cancelation of the exemption from taxation of dividends if certain conditions are met (3 years of controlling ownership) with the introduction of taxation of dividends paid to non-residents. From 2023, there is a 10% withholding tax rate applied to the dividends paid to non-residents.

These changes were intended to encourage businesses to reinvest funds in the local economy, implement capital repatriation and incentives to return capital to the country, and strengthen barriers to the outflow of funds to offshore. In this regard, “immaterial services” have been considered equivalents to dividends, which in the world practice are not deductible for income tax purposes. For example, management decisions made by the parent company about the subsidiary mainly have the goal of increasing dividends and the value of the subsidiary and, therefore, cannot be regarded as business-oriented expenses, as the parent company will already profit from its management decisions in the form of increased dividends and the value of the company. To avoid “paper” and non-operating expenses, it is proposed to limit CIT deductions under Article 288(3-2) of the Kazakhstan Tax Code to 3 % of taxable income.

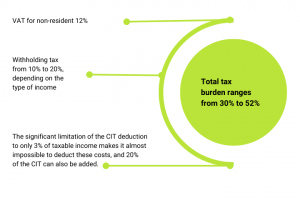

Let’s take a concrete example to assess the implications of these tax amendments on a particular company. For example, a subsidiary of an international company that has a number of intragroup contracts with either the head office or other subsidiaries within the group. Basically, the limitation of CIT deductions means that the subsidiaries are entitled to the additional CIT burden of 20 %. Therefore, the intragroup agreements on so-called “immaterial services” might be subject to a significant tax burden which varies from 30% to 52 % above the costs:

These changes have undoubtedly caused a resonance among the tax community and the country’s businesspeople who are concerned about the current wording of Article 264, which opens the door to various interpretations and manipulations. The foreign companies or subsidiaries of the international companies provide reasonable counterarguments by stating that so-called “immaterial expenses” are, in fact, absolutely legitimate, business oriented, and based on the contracts that bring investments, goods, and services of international companies into the country.

Moreover, in the era of technological innovation and globalization, the costs of high-tech goods/services are “immaterial” in the majority, such as technology patents, franchising, agency, engineering, the right to use intellectual property, licenses, and trademarks. With the new amendments and unjustified additional tax burden, it will be economically unprofitable to “bring” high-tech goods and services to Kazakhstan.

The situation is similar to other types of “immaterial” services such as advertising, marketing, consulting, and other related services that are an integral part of operating business processes within international companies, which are profiting from economies of scale and unification of the marketing and advertising strategies on the global level.

How might this affect Kazakhstan businesses and the random consumer? There are concerns that introducing the additional tax burden on foreign investors will make it more expensive to do business in Kazakhstan, leading to an outflow of foreign investment and lower tax revenues for the local budgets. Moreover, the opposite effect could lead to an increase in the cost of imports and, eventually, higher inflation.

We do believe that these amendments and their implications would require a broader discussion at the various business platforms among the business community which should involve all stakeholders: government agencies, local businesses, and foreign investors.

Baker Tilly Qazaqstan Advisory will also be involved in discussing this topic. We have become a holder of a qualification certificate and are a tax consultant organization, which entitles us to provide tax audit services, legal entity liquidation, client representation, and support services during tax audits by state authorities.

Baker Tilly Advisory also provides a wide range of business and real estate valuation services, M&A support, corporate finance, strategic consulting, and other advisory services. We are committed to providing comprehensive assistance to our business partners. Our specialists will become part of your team and, as experienced navigators, help your business navigate the legislative reefs to succeed together with you.

If interested, contact us at info@bakertilly.kz or +7 (727) 355 47 57 (ext. 201)

Authors of the article: Elena Hegai, Partner in Taxes and Accounting +7 727 355 47 57 (vn, 120)

Rustem Umurzakov, Senior Tax Consultant

Abay Mukanov, Tax Consultant