From the user’s perspective

How non-financial indicators reflect the outcome of bank ratings

In this article, the Baker Tilly team analyzes other factors characterizing Kazakhstan banks that are unrelated to financial indicators. While these factors were not considered when calculating the rating they may indirectly impact the final standings through influencing users’ choices.

The first part of our analysis related to non-financial indicators is based on data from the official websites of banks and the 2GIS application (in terms of branches and ATMs) for May 2023.

We reviewed the regional representation, individual product rates, and legal entity product rates. Also, we conducted a small survey to determine how users feel about their banks, why they choose them, and what parameters they would like to see improved.

As a year before, by territorial coverage (coverage of cities, number of departments and ATMs) Halyk Bank was in the lead, followed by Kaspi, then by different parameters the leaders were divided: by the number of departments Eurasian Bank was third, by the number of ATMs – Jusan Bank.

Over 2022 the refinancing rate increased from 10.25% at the beginning of 2022 to 16.75% by the end of 2022, pulling the rates of return on loans and deposits. At the same time, certain phenomena have been observed at individual banks that do not fit into the overall system picture, which raises the question of how sustainable the banks offering such rates are, and whether such terms, as outlined on the website, are exclusively a marketing tool.

In general, the median of the maximum rates on deposits of individuals on the system was formed at 16.05%, if we consider the information on the official websites of the banks. The maximum rates on the date of analysis were offered by VTB Bank and KZI Bank with the rate of 18.3%, followed by Bereke (17.7%).

The median minimum rates on unsecured consumer loans as of the date of analysis was at 25.4%. At the same time, according to the official information on the website, Bereke Bank offered minimum rates on unsecured consumer loans from 8.38% GESV, which raises questions about how such rates are financed with deposits of 17.7% and the refinancing rate of 16.75%. Perhaps at the expense of other portfolios, as consumer loans in Bereke’s portfolio accounted for about 17% of its loans, but it is most likely a marketing story for the short term, as its sustainability in the long term is questionable. Also, the rate for unsecured consumer loans is significantly lower than the refinancing rate, according to the official website, offered by RBC Bank (from 10.38% GESV).

From the point of view of technological development, it should be noted that most retail banks have implemented the function of P2P transfer by phone number, and also allow opening a deposit and getting a loan without visiting the bank. At the same time, the possibility of payments via QR is available for customers of 6 banks: Kaspi, Halyk, Jusan and joined them last year by RBK Bank, Home Credit Bank and Freedom Bank. At the same time the competition for this market has increased, we managed to find information about the cost of QR payments at the websites of 4 of the listed 6 banks, the data are summarized in the table below:

Overdraft terms differ in the various approaches to limits, depending on the bank. Nominal rates range from 19.2% per annum (Freedom) to 39.9% (Jusan). At the same time, the limits and rates, are often set individually, depending on the turnover of the account. According to the information on the official websites of the banks, Jusan offers the maximum limit – 100 million tenge, or up to 50% of the account turnover. Freedom Finance offers an overdraft of up to 50 mln. tenge for 30 days at 0% with a fee per transaction of 1.6% (equivalent to 19.2% per annum). The terms also vary from 30 days to 12 months.

Halyk Bank remains the leader in terms of diversification of the portfolio of services offered, with a wide range of B2C and B2B products, developing non-financial products, as well as having its own brokerage company. There is also an interest in diversifying the product offering from other banking groups; in particular, Freedom group is growing very actively, including through M&A deals – there is a strengthening of insurance block and non-financial products, further development of the leading brokerage direction, Forte and Jusan are developing non-financial products, BCC is strengthening its position in retail and working with SMEs.

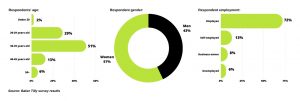

As a result of second part of our research more than 200 persons were interviewed, mostly from Almaty (76% of sample), Astana (8.33%) and from other cities of Kazakhstan. In total, respondents from 19 cities of Kazakhstan participated.

Respondents are mainly employed in consulting, construction, finance (except for banks), information and communication, trade, mining, and others, with none of the above areas, except for “other”, occupied more than 17% of the sample. The survey results were cleaned of bank employees’ responses (9 responses) in order to eliminate a possible bias factor.

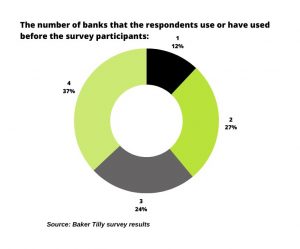

Most respondents (more than 37%) used the services of more than 3 banks, respondents who used only 1 bank – only 12%.

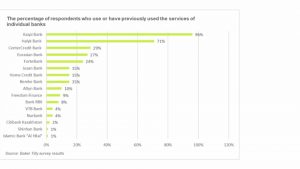

According to our sample, the graph below shows the % of respondents who used the services of individual banks

Next, we asked which bank the respondents have salary project and which bank is the “main” for them – the most frequently used products. As a result, the top three in the number of payroll project users among respondents looked as follows: Kaspi (33%), Halyk (28%), Eurasian (14%). At the same time, 77% of the sample named Kaspi as their main bank, 10% named Halyk, and 4% named BCC. This picture shows that salary project is not a determining factor for people in choosing the main bank, and people are willing to pay fees when withdrawing money to their main bank.

An interesting fact is that people gave quite different answers to the questions “What are the main advantages of your main bank” and “What would you improve in your payroll bank? The only matching factor in the top 3 was the convenience of the mobile app. Also among the significant advantages of the main bank, despite 78% of non-cash cards turnover for individuals in Kazakhstan, 63% of respondents mentioned a large number of ATMs. On a question “What would you improve in your payroll bank” 45% mentioned the loyalty program, while in the rating of advantages of the main bank (to understand the reasons why people use it and not salary bank) – the loyalty program is not included in the top 3. If this phenomenon were confirmed on a larger sample, we could say that improving UI/UX applications and infrastructure has more impact on the actual choice of the main bank than cashbacks, bonuses and other loyalty terms. That said, it should be noted that “Loyalty” in both question forms garnered nearly the same % of mentions, which suggests that this factor remains important to 44-45% of users.

Olga Zagidullina, Ramina Nazyrova, Daria Samodurova, Baker Tilly Qazaqstan Advisory