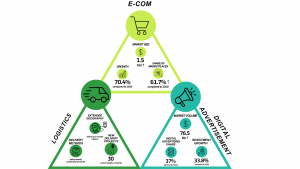

Kazakhstan’s e-commerce market has surpassed USD 1.5 trillion, once again showing a particularly high growth rate in 2021. Against the backdrop of established trends such as the growth of marketplaces, the introduction of BNPL service and the influence of FinTech companies, the e-com market has changed significantly over the past year.

The world will never be the same.

Despite the fact that the pandemic hit the world hard economically, it was the starting point for the development of e-commerce. While virtually all industries lost billions during the shutdown, e-commerce has shown its full benefits and has become an integral part of people’s lives. At the end of 2021, the global market will reach USD 4.9 trillion, up 16.8% over the previous year, according to Statista.

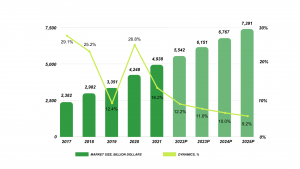

Over the past five years, the dynamics of the global e-commerce market have been at an incredibly prominent level, with an average annual growth rate of 25%. However, 2021 is the potential end of that trend. Statista predicts the global e-com market will cross the USD 7.3 trillion mark by 2025, and the annual growth rate will decelerate to 9.2%.

Dynamics of the volume of the global e-commerce market

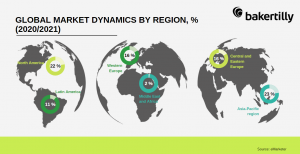

Among global regions, the Asia-Pacific region showed the greatest growth in 2021 – 23% and North America – 22%. At the same time, the average annual growth rate in Europe reached 16%.

After the unprecedented boom in online spending sparked by Covid-19, e-commerce adoption continues across all industries. Computers and electronics have a 21.5% market share, while the apparel category has a fifth of the entire e-commerce market, according to InsiderIntellegence.

One continuing trend is the growth of marketplaces. Sales of marketplaces such as Amazon, eBay and AliExpress and are growing steadily every year, and this category accounts for two-thirds (67%) of global e-commerce in 2021. For example, according to eMarketer, Amazon alone has a 41.4% share of all e-com sales in the United States. On the other hand, despite the limitations of social platforms, nearly 20% of companies intend to sell through TikTok and Instagram.

“Buy now, pay later,” or buying in installments, has become a major trend in the e-commerce market. Installments are a tool to increase sales, which reduces the financial pressure on the consumer. In 2021, large FinTech companies with a core BNPL service emerged, and at the same time merchants themselves began offering the installment purchase option.

Digital advertising, which is an integral part of e-commerce, grew 29.9% to reach the USD 521 billion mark, according to eMarketer. The U.S. spends the most on online advertising, where the USD 200 billion digital advertising market continues to grow in double digits. It is also worth noting that every industry has increased ad spending by at least 10% in 2021, which may be an indicator of long-term change.

According to a joint study by Baker Tilly and Forbes, the sizein Kazakhstan has almost tripled over the past two years.

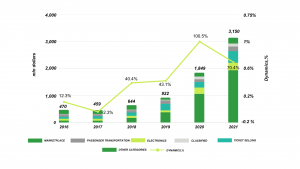

Growth dynamics of retail e-commerce market size in Kazakhstan, mln USD

With an annual growth rate of 70.4%, Kazakhstan’s e-commerce market is still in the process of accelerating development. In 2021, total revenue of online sales exceeded KZT 1.5 trillion (USD 3.5 billion), according to Baker Tilly.

Key indicators of the e-commerce market in Kazakhstan

Residents are also visiting online stores more frequently, as shown by the average number of monthly visitors, which increased 67.8% to 2.4 million per month. The conversion rate is more than double the standard 2.86% for the global e-commerce market.

Kazakhstani people buy online almost twice as much as in 2020, as evidenced by 93,000 completed online transactions per month on average. According to the Association of Financiers of Kazakhstan, the volume of non-cash card transactions in 2021 amounted to KZT 72.3 trillion (2.1x growth), and purchases account for 82% of all non-cash transactions.

At the same time, residents began to spend more, which indicates growing confidence in online shopping. The average bill reached KZT 54 thousand, whereas in 2020 it was only thirty-eight thousand. Even taking into account inflation, these figures are an indicator of significant growth in this industry and the continued transformation of retail into a new format.

Over the past five years there have been tremendous changes in the structure of the e-commerce market. The share of marketplaces has increased fourfold, reaching 61.7% in 2021. In the same period, there has been a decline in the electronics and clothing categories, due to the blurring of sector boundaries and the influence of the FinTech industry.

The main driver of online sales is digital advertising.

Compared to 2020, investment in online advertising increased by 33.8%, which may be both a cause and a consequence of e-commerce development. According to the Central Asian Advertising Association, Kazakhstan’s advertising market reached a volume of 76.5 billion tenge last year. In 2021 digital advertising accounted for 37% and was behind only TV advertising (44%).

The largest player in this market is YouTube, which has dominated for several years with a 58% market share. Krisha and Kolesa have 14% and 16% of the market, respectively.

National logistics industry is beginning an active phase of development.

The geography of logistics is expanding. Companies are beginning to deliver to remote regions, which can also create new impetus for e-commerce growth. The methods of delivering goods are improving. Pickup points, “postal terminals” and automated terminals are already active in large cities. For example, the largest player on the e-commerce market, the company Kaspi, has launched a new project, Kaspi Smart Logistics, to which thirty logistics companies are already connected, covering the entire territory of Kazakhstan.

Over the past year, several trends in the development of e-commerce in Kazakhstan have been established:

- The market continues to grow, but at a more moderate pace. Over the past two years, the average growth rate has been about 40% per year, and it is likely to grow at a lower rate in the coming years.

- e-com market players are shifting their focus to social networks and new forms of advertising. As early as 2021, a massive portion of SMBs is operating through Instagram, and social media’s share will grow rapidly. TikTok will become an alternative to Instagram, and most advertising will move to short videos.

- The lines between sectors are blurring. Every year it becomes increasingly difficult to distinguish a bank from an online store, as market players try to diversify their services as much as possible, positioning themselves as FinTech. Over the past few years, the market leader has been Kaspi, and we are also seeing active development of ForteMaket, HalykMarket and JMart.

The e-commerce market in Kazakhstan will undergo huge changes in 2022.

“We expect that the market will grow in the next 5 years by 40-50% annually. In general, of course, this is an extremely high growth rate for the market, there are great opportunities, especially for local marketplaces and merchants.”

Dmitry Komissar, ForteMarket

The FinTech industry has become an integral part of e-commerce and will continue to have a significant impact on the course of development of this market in the future.

Due to the aggravation of the geopolitical situation, the country’s logistics industry will face unprecedented pressure. Kazakhstan remains, in fact, the only way between Europe and China, and with the right approach, the logistics industry can reach a new level on an international scale. This, in turn, will give a new impetus to the development of e-com.

Up until the end of 2021, the development of e-commerce in Kazakhstan took place without any state regulation. However, since January 2022, a so-called “Google tax” has been introduced. Now the tax burden will be the same for both local sellers and non-residents. This innovation could have a negative impact on buyers, since all foreign companies will pay the tax at the expense of the buyers themselves, raising prices. At the same time, the digital tax will provide a competitive environment for local e-commerce marketers. Time will tell whether the overactive increase in online sales will end or whether domestic giants will emerge in this market.

See more informaion about analysis of retail e-commerce in Kazakhstan 2021 by clicking here Analysis of Retail E-commerce in KZ_2021