In recent years, the e-commerce market has reached an unprecedented global scale, fundamentally changing the way consumers shop and do business. The digital revolution has transformed traditional retail models and has shaped the dynamics of retail around the world.

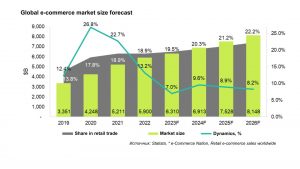

The size of the e-commerce market exceeded $5.9 trillion in 2022, accounting for 18.9% of global retail sales. Statista forecasts this figure to exceed 22.2% by 2026. Mobile commerce (m-commerce), cross-border e-commerce and the integration of online and offline retail (omnichannel) have been key growth drivers. In addition, sustainability is an important trend, as consumers seek to purchase eco-friendly and socially responsible products. Social commerce, driven by the integration of shopping functions into social media platforms, has become a new impetus for e-commerce growth. The widespread adoption of digital payment methods, subscription services, and the rise of social commerce are also driving the industry. Emerging markets have witnessed explosive growth as internet access has rapidly expanded. However, the sector also faces challenges related to competition, logistics, regulation and the need to build and maintain consumer trust.

The dominating global e-commerce players include Amazon, Alibaba, JD.com, eBay and Walmart, with Amazon and Alibaba holding particularly significant market shares. These giants operate in several regions and countries, which also indicates the international nature of the e-commerce industry. In terms of major market regions, North America, led by the U.S., accounts for a significant share due to the presence of industry leaders such as Amazon and Walmart. The other most important region is Asia, especially China, where Alibaba and JD.com play a key role. Europe, where companies such as Zalando and ASOS have a strong presence, has also developed a thriving e-commerce market.

Central Asia

The Central Asian region, comprising countries such as Kazakhstan, Uzbekistan, Turkmenistan, Kyrgyzstan and Tajikistan, is a diverse economic landscape characterized by both opportunities and challenges. Historically known for their strategic location along the Silk Road trade routes, these countries have experienced varying degrees of economic development since their independence from the Soviet Union. Rich in natural resources, particularly oil and gas in countries such as Kazakhstan and Turkmenistan, the region has seen an increase in energy exports. In addition, Central Asia’s economic landscape is influenced by agriculture, mining, manufacturing and remittances from foreign workers. However, challenges remain in the region, such as political instability, infrastructure deficits and lack of economic diversification.

Central Asian countries, with the exception of Kazakhstan, are notably lagging behind in e-commerce. Due to the high level of traditional retailing represented by markets (bazaars) and the low level of digitalization, the share of online retailing in Uzbekistan and Kyrgyzstan remains particularly low.

Kazakhstan’s potential

Kazakhstan, a vast and culturally rich country located at the crossroads of Europe and Asia, is striving to play a key role in the ever-changing landscape of global e-commerce. As the digital revolution sweeps the world, Kazakhstan is becoming a dynamic player attracting the attention of businesses, investors and consumers.

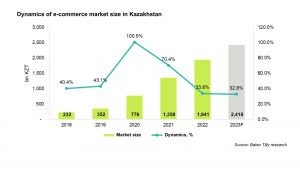

Kazakhstan’s strategic location in the heart of Eurasia makes it a bridge between East and West, making it an attractive destination for companies seeking access to a diverse and extensive consumer base. The government’s proactive digitalization efforts, including digital payment systems and supporting legislation, are driving the development of e-commerce. A growing middle class, a particularly high internet penetration rate (89.2% in 2022) and the proliferation of smartphones have created a favourable environment for online shopping and fostered a vibrant e-commerce ecosystem. In addition, Kazakhstan’s influence extends beyond the country’s borders, facilitating the development of cross-border e-commerce and providing international companies with access to the wider Eurasian region.

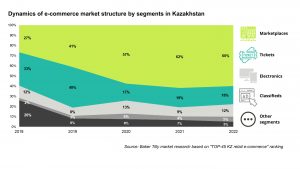

As e-commerce starts to expand, there is a trend of increasing marketplace share (60% in 2022), which correlates with the major changes in the global market. At the same time, the decline in the share of other categories is due to both the growth of marketplaces and external factors. For instance, the volume of online ticket sales was significantly impacted by pandemic restrictions, followed by an unstable geopolitical situation in the region. Classifieds, in turn, showed a decline in growth rates due to the growing social commerce segment, amid the activity of small and medium-sized businesses in social networks.

Future trends of e-commerce

The e-commerce market in Kazakhstan was initially formed in non-standard conditions. The most significant influence on the pace of market development was exerted by second-tier banks, starting their paths towards ecosystemization, offering a combination of financial products and e-commerce services.

One of the emerging trends in Kazakhstan’s e-commerce market is the rapid adoption of mobile and digital payment solutions. As smartphone usage grows, consumers increasingly use their mobile devices to make purchases due to convenience. This trend is changing the approach to e-commerce in Kazakhstan: companies are optimizing their platforms for mobile users and offering payment methods that are convenient for them.

Due to the unique geographical features of Kazakhstan, the e-commerce sector is trending towards innovative logistics and supply chain solutions. The country’s vast territory and diverse landscapes create logistical challenges, especially in remote areas. To address these challenges, businesses are adopting advanced technologies such as route optimisation, real-time shipment tracking, and efficient warehousing systems. It should be noted about the active development of E2E (End-to-end) logistics and the increase in the number of delivery points.

According to Rauan Karabay, Partner of Wildberries in Kazakhstan, some players are starting the process of localization of processes in Kazakhstan. International companies are actively opening warehouses, fulfilment centres and delivery points, which not only contributes to the development of e-commerce through the logistics segment but also opens up employment opportunities for the population.

Looking to the future

The prospects for the development of e-commerce in Kazakhstan are promising and have the potential for further growth and development. Looking into the future, the opportunities to introduce new technologies such as artificial intelligence and virtual reality/ augmented reality (VR/AR) are very attractive. Artificial intelligence can improve personalisation, recommendation systems and customer service, while VR/AR can provide immersive and interactive shopping experiences. These innovations, combined with the drive to improve logistics and the convenience of multi-channel retailing, have the potential to shape the future of e-commerce in Kazakhstan, making it more dynamic, customer-centric and accessible to consumers across the country.

Moreover, with the development of the domestic e-commerce market, Kazakhstani players can be expected to enter the markets of neighbouring Central Asian countries and become regional pioneers in cross-border e-commerce and trade, contributing to the economic integration of the entire Eurasian region.

Ramina Nasyrova, MRICS, Partner Baker Tilly Qazaqstan Advisory

Magzhan Saidalin, M&A Deal Advisory Consultant