The rows have realigned

The large banks 2022 strengthened their positions, the struggle worsens in the middle of the list

Despite the intense geopolitical situation in the world and the region, in 2022 the banking sector in Kazakhstan showed a fairly rapid growth compared to the previous year. At the beginning of 2023 banks demonstrated an increase in assets (+18.4% for the system), capital (+15.3%), loan portfolio (+20.1%), deposits (+18.9%) and total net profit of the sector (+13.7%).

We should also note that the consolidation of banks that began in 2022 continued under the influence of both systemic processes in the banking sector and the changes that occurred in the international banking system as a result of the war in Ukraine and the ensuing sanctions. Thus, on April 6, 2022, Bank CenterCredit completed the acquisition of 100% of DB Alfa-Bank’s common shares. After DB Alfa-Bank’s re-registration, it initially began operating under the brand of Eco Center Bank, a subsidiary of BCC, but later decided to reorganize and merge Eco Center Bank into BCC. This event put BCC in the top three of the rating at the end of the year and significantly strengthened its position, especially in terms of products for SMEs and individuals.

In 2022, there was also a purchase and sale transaction between Baiterek National Holding and a subsidiary bank of Russian Sberbank in Kazakhstan. The deal was closed on September 1, after which on September 12, 2022, SB Sberbank (Kazakhstan) was renamed Bereke Bank. It is important to note that for a long time, SB Sberbank was under sanctions due to the geopolitical situation in the world. However, after another petition by Baiterek Holding with a request to remove Bereke Bank from the sanctions list, in early March 2023 the sanctions were lifted from Bereke Bank by the U.S. Treasury Department, due to the fact that the bank no longer belongs to the Russian Sberbank. Nevertheless, the result of this bank in the rating (minus 12 positions) is largely due to the restrictions associated with the sanctions, which were in effect for most of the year.

It should be noted that such deals can have different effects, both on the state of individual banks and on the banking sector as a whole. We find that the accession of SB Alfa-Bank to BCC had a generally positive effect on the latter due to the consolidation of portfolios, clients and some services, allowing a rapid scaling of the portfolio and providing a “fresh blood rush” in terms of professional staff. At the same time, the acquisition first of the portfolios and then of the former SB Sberbank itself, which before the well-known events in February 2022 was among the top three in terms of assets, is from our point of view more a political than a full investment decision. Further developments, depending on the scenario chosen “at the top”, may include both an attempt to build a kind of state bank (and move Halyk Bank from its historical position as the main bank for the quasi-bank sector) and an attempt to sell this asset to an interested party inside or outside of Kazakhstan.

At the same time, in the past year significant changes in legislation were adopted, opening the way for the transformation of MFIs into banks, which would give large microfinance organizations access to cheaper sources of financing. KMF and OnlineKazFinance MFI (operating under the Solva brand) have already voiced their desire to transform into a bank.

Also, it is expected to reduce the requirements for the risk regulation of banks – so the National Bank is trying to revive lending to the economy in conditions of high-interest rates, which can have a short-term positive effect in the form of the release on the market the released liquidity, but increase the risk of system stability in the long term through a combination of high rates and reduced quality of the portfolio.

At the beginning of 2023, there were 21 banks operating in Kazakhstan. Compared to last year, only one bank – SB Alfa Bank, merged with BCC, stopped operations, and one more bank (SB Sberbank) rebranded.

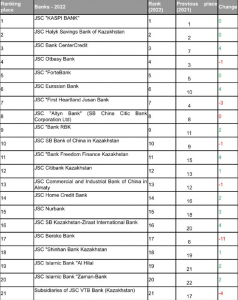

By the end of 2022, Kaspi Bank remained the leader of the ranking of Kazakh banks, relying on high rates of return on assets and equity, with the growth of the portfolio and assets above the median for the market. Halyk Bank, the leader in terms of assets, is in second place in the overall ranking, while BCC ranks third, having displaced Otbasa Bank from the top three. The financial indicators of the banks as of January 1, 2023, and the latest ratings of rating agencies available as of the date of analysis were taken into account when calculating the rating.

Significantly, such banks as BCC, Citibank Kazakhstan, Eurasian Bank, Freedom Finance Bank Kazakhstan, Nurbank, and Shinhan Bank Kazakhstan increased their positions in the rating. In particular, BCC moved up by 4 positions, from 7th to 3rd place, mainly due to the acquisition of SB Alfa-Bank, this event led to an almost two-fold increase in assets, capital and loan portfolio compared to 2021.

Eurasian Bank moved up 4 lines in the ranking of banks and took 6th place, mainly due to an almost two-fold increase in assets, capital and loan portfolio. The bank increased its lending mainly due to large enterprises, unsecured consumer loans and car loans.

Freedom Finance Bank moved up 4 positions to #11, mostly due to the highest growth rate in assets, deposits, and loan portfolio (but this was significantly affected by the low base effect). The bank is actively developing its retail products, particularly “digital mortgage”.

Among the banks that have fallen from their positions in the ranking are First Heartland Jusan Bank, Bereke Bank and DO Bank VTB (Kazakhstan). Bereke Bank dropped by a record 12 positions and took 18th place as a result of portfolio and asset reduction due to the impact of sanctions. VTB lost 4 positions for the same reason and was ranked 21st. First Heartland Jusan Bank dropped 3 positions and took 7th place in the ranking of banks. The bank showed an increase in indicators, but the growth rate and profitability were below the market average, which led to the reduction of the position.

Assets and loan portfolio

In 2022, the assets and loan portfolio of STBs showed a positive trend. Thus, at the beginning of 2023, the total assets of the banking sector amounted to 44.6 trillion tenge, which is 18.4% more as compared to the previous year. The loan portfolio is the main part of assets, as it occupies 52% of the total assets. The amount of loans at the beginning of 2023 amounted to 24.3 trillion tenge, showing a growth of 20.1% YoY. The growth of banks’ loan portfolio is mainly due to active lending to individuals: by the end of 2022, 13.2 trillion tenge (54% of all loans) were issued within the system.

Halyk Bank more than three years remains a leader in terms of assets, the amount of which at the beginning of 2023 amounted to 13.9 trillion tenge (+19.18% YoY). Kaspi Bank is in the second position, while BCC is in the third place with the amount of assets reaching KZT5.09 trln and 4.35 trln, respectively. In general, the level of asset concentration remains high: over 30% in Halyk Bank and over 50% in the first three banks by assets.

Freedom Finance Kazakhstan demonstrated maximum growth of 217.6% in assets, while BCC and Eurasian Bank gained 110% and 66.4%, respectively. Assets grew at all banks, except for Bereke Bank, VTB Bank SO and Al Hilal Islamic Bank. VTB Bank SO and Bereke Bank showed a 61.9% and 59.9% decrease in the volume of assets, respectively.

The highest growth rate of the loan portfolio was demonstrated by such banks as Freedom Finance Bank Kazakhstan – by 1417% (+320bn Tenge), BCC – by 73% (+912bn Tenge), Eurasian Bank – by 60% (+432bn Tenge). At the same time, some banks reduced their portfolios, in particular VTB Bank, Bereke Bank and “Commercial and industrial China in Almaty”, the index decreased 53%, 50% and 38%, respectively.

The amount of overdue indebtedness in the system in 2022 was 1.2 trillion tenge or 4.85% of the portfolio, which is 10.6% more than in 2021. The overdue indebtedness exceeding 90 days comprised 814 billion tenge or 3.36% of the portfolio. The largest growth of overdue indebtedness over 90 days in absolute terms was demonstrated by Kaspi Bank (+ 75 billion, or 75% as compared with 2021), First Heartland Jusan Bank (+ 29.8 billion tenge, or + 30% as compared with 2021), Eurasian Bank (+ 23.9 billion, or +58% as compared with 2021). As for the share of overdue debt in the portfolio, the highest values were observed in First Heartland Jusan Bank (11.47%), Bereke Bank (8.08%), and VTB SO Bank (8.07%). BCC and DB KZI Bank saw the largest decrease in the overdue debt portfolio, by KZT7.3 bn and KZT6.5 bn, respectively.

Also, it is worth noting that not all banks reflected in regulatory reporting loans overdue for more than 90 days – five banks did not have them: Freedom Finance Bank, Altyn Bank, “Commercial and Industrial Bank of China in Almaty”, Bank of China in Kazakhstan, Al Hilal Islamic Bank.

Deposits and capital

The deposits as of the beginning of 2023 amounted to KZT31.6 trln and increased by 21.5% compared to the last year. Deposits accounted for 80.3% of the total liabilities of the banking sector, of which 53.6% were individual deposits. In terms of currency structure of deposits, 66% of household deposits at the end of 2022 were placed in tenge.

The amount of the BVU equity capital in 2022 amounted to KZT 5.2 trln, the increase since 2021 was 15.3%.

The leader in deposits and capital, as well as in 2021, is Halyk Bank. It is important to note that the volume of deposits of Halyk Bank is one-third of the total deposits of the banking sector by the end of 2022, as the value was KZT 10.3 trln. By capital, Halyk Bank occupies 36.1% of the total capital of the banking sector, the index amounted to KZT 1.89 trln. Kaspi Bank ranks second by deposits and capital, the indicators amounted to KZT 4.1 trln and 0.5 trln, respectively.

It’s worth noting that deposits at Freedom Finance Bank Kazakhstan grew by 472% from KZT103.6bn to KZT593.4bn. While VTB Bank and Bereke Bank experienced 86% and 60% deposit contraction. Bereke Bank showed the largest capital decrease, by 65%, while the maximum increase, by 87%, was shown by BCC.

Net profit and ROA, ROE indicators

The net profit of the banking sector in 2022 amounted to 1,461 bln tenge showing a growth of 13.7% compared to 2021. Positive dynamics of net profit are a good indicator not only for the banking sector but for the economy as a whole. Return on assets (ROA) and return on equity (ROE) are also equally important indicators of bank performance.

According to the data, all banks showed positive net income results in 2022, with Halyk Bank (KZT539.3bn), Kaspi Bank (KZT361.7bn), BCC (KZT145bn), Citibank Kazakhstan (KZT100.2bn) and Otbas Bank (KZT96bn) among the most remarkable ones.

By high profitability indicators in 2022 two banks stood out: Kaspi Bank and Citibank Kazakhstan. Kaspi Bank is a leader in terms of return on assets (8.3%). Citibank Kazakhstan (8.2%), Al Hilal Islamic Bank (5%), TPB China Almaty (4.7%) and BCC (4.5%) also showed high rates of return on assets. In terms of return on equity, Citibank Kazakhstan (78%), Kaspi Bank (77%) and BCC (69%) are in the lead.

To continue last year’s idea, the Baker Tilly Kazakhstan team conducted a comparative analysis of the terms and conditions of the B2C and B2B products offered by banks.

They also conducted a survey on a sample of banking service users to understand how consumers evaluate the banks they use, how they choose a bank and where they would turn first.

Olga Zagidullina, Ramina Nazyrova, Daria Samodurova, Baker Tilly Qazaqstan Advisory