High demand for commercial real estate, in which foreign policy factors played an important role, continues to drive rental rates up in the market.

High demand for commercial real estate, in which foreign policy factors played an important role, continues to drive rental rates up in the market.

Baker Tilly has conducted an annual analysis of commercial real estate in Kazakhstan, which examines the key changes, major trends, and prospects for the market.

In 2024, Kazakhstan’s commercial real estate market will continue to develop actively despite economic challenges and natural disasters. The key growth catalysts were low vacancies, increased business activity, and the inflow of international companies. At the same time, some consumer preferences have changed over the last year.

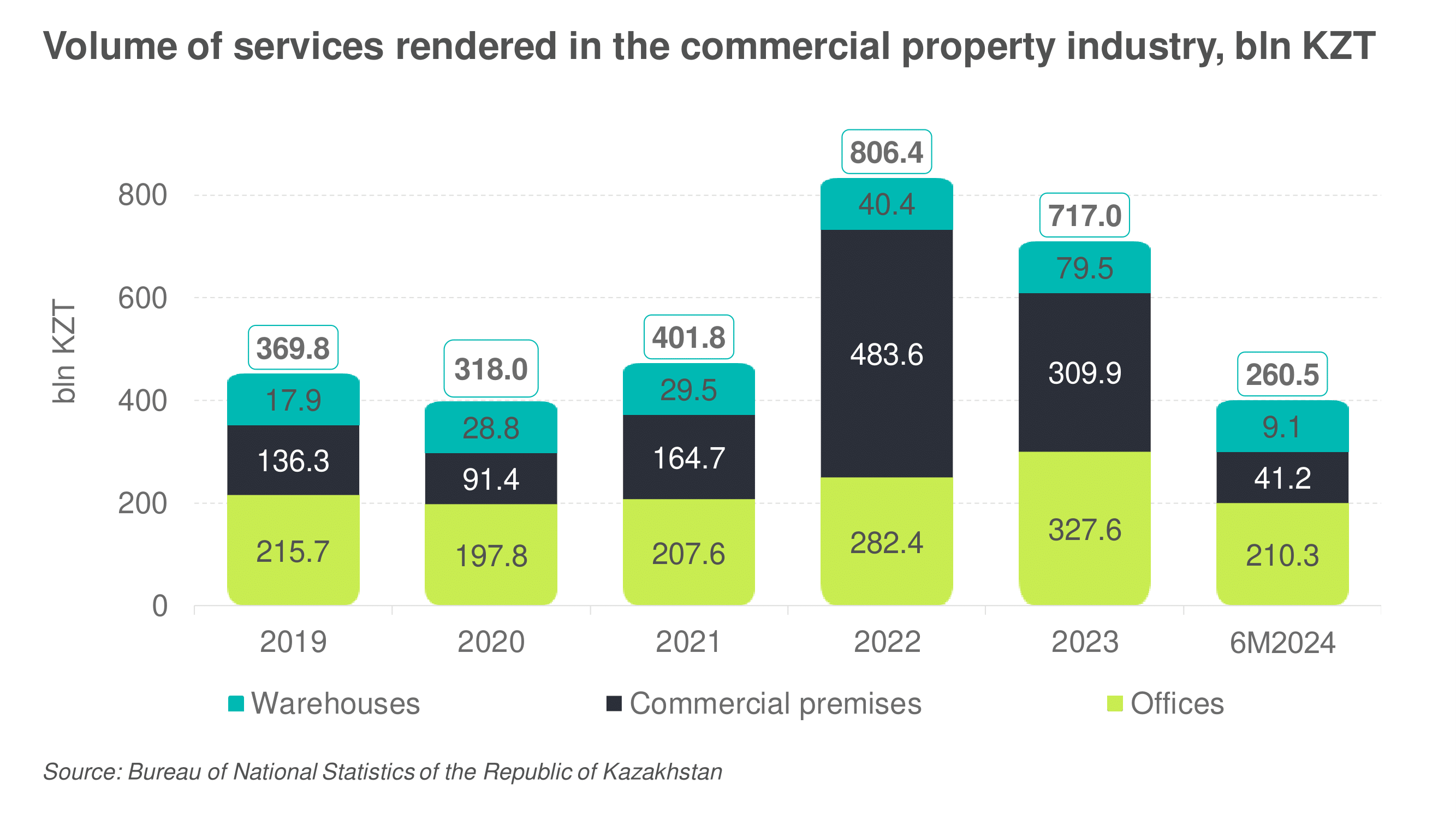

In 2023, the volume of services rendered for the lease and operation of offices, retail, and warehouse premises in Kazakhstan amounted to 717 billion KZT, showing a slight decrease of 11% to the results of 2022, which is due to the stabilization of sales in shopping malls and shopping and entertainment centers, which was caused by an increase in attendance of shopping and entertainment centers by citizens of the Russian Federation. At the same time, comparing the pre-pandemic period – 2019, as well as the results of 2023, the volume of services provided by commercial real estate owners increased by 94% (from 370 billion KZT). The growth of the indicator is due to an increase in rental rates for commercial real estate, as well as an increase in the volume of space in the market. Kazakhstan and Central Asian countries are attracting more and more foreign investors due to economic growth, political stability, and active investment policy of the states, as well as due to the favorable geographical location and the position of “transit countries”.

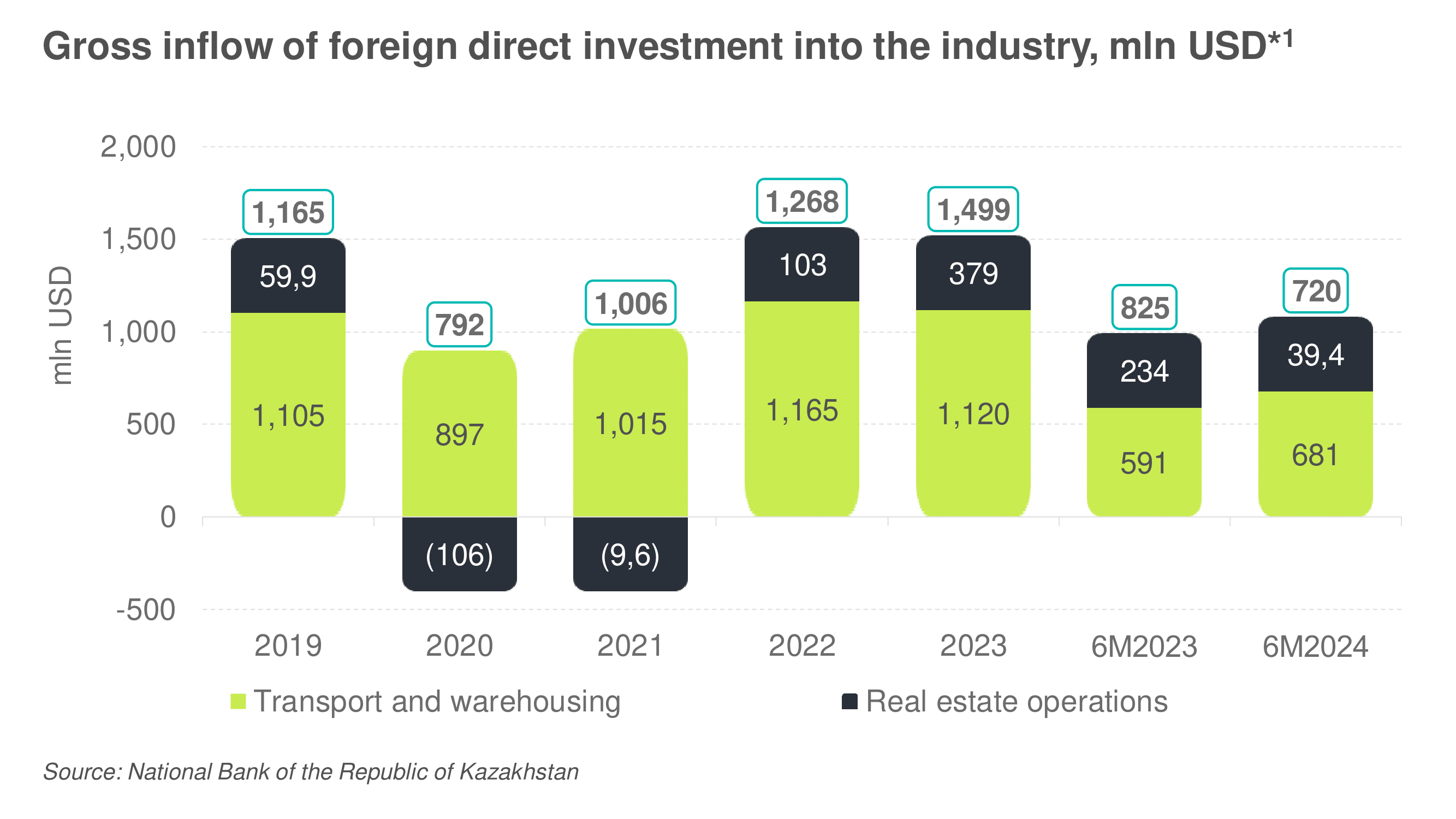

One of the reasons acting as a catalyst for market growth has been the increasing foreign interest in the “real estate, transportation, and warehousing” industry.

Gross inflows of foreign direct investment (FDI) in Kazakhstan for 2023 in the real estate and transportation and warehousing industries amounted to 1,499 million USD, of which – 1,120 million USD in the transportation and warehousing segment and 379 million USD were utilized in real estate transactions. For the period of 6 months of 2024, FDI in the transportation and warehousing industry amounted to 681 million USD, which represents an increase of 15.1% over the same period.

At the same time, investments in real estate operations for 6 months of 2024 showed a decrease of 83.2% and amounted to 39.4 million USD. In the same period of last year, FDI amounted to 234 million USD. This was due to a sharp increase in foreign presence in the industry in 2023 due to the relocation of Russian companies, but this trend went down in 2024.

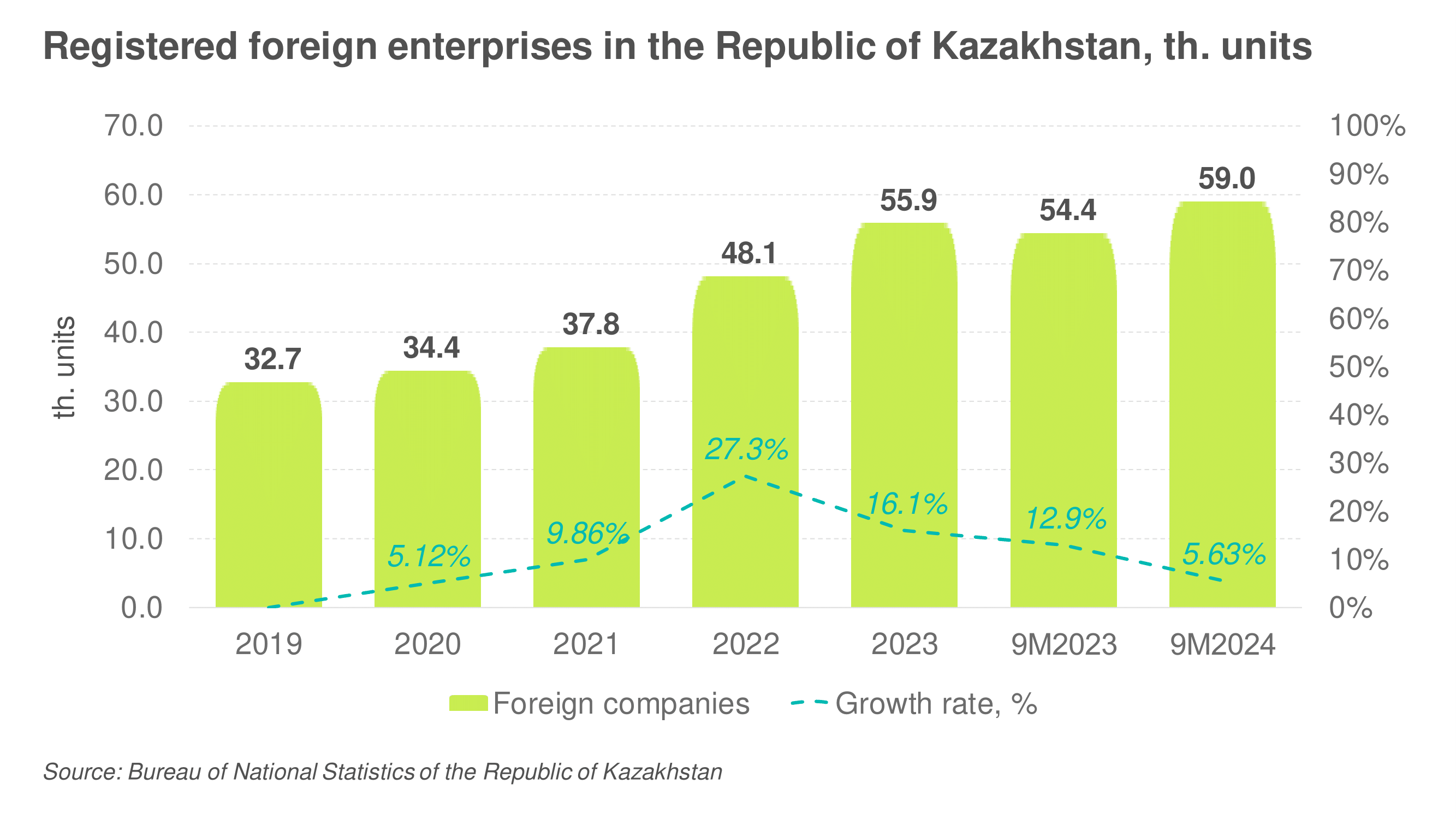

Investor interest is also reflected in the growing number of foreign companies in the country. In 2023, 55.9 thousand foreign enterprises were registered in Kazakhstan, while as of 9 months of 2024, the number increased to 59.0 thousand organizations. According to the Ministry of Trade and Integration, more than 160 major foreign companies opened their offices in Kazakhstan in 2023, such as Wabtec, Microsoft Corporation, and Yandex.

It is worth noting the strengthening of economic cooperation with China. As of 9 months of 2024, more than 4.6 thousand enterprises with Chinese capital are registered in the country, 710 of which have been registered since the beginning of 2024. In 2023, China invested about 1.7 billion USD in Kazakhstan, which is 15.3% more than in 2022.

The project of the Chinese side “One Belt and One Road”, aimed at the development of infrastructure and economic cooperation through the creation of new and reconstruction of current transport corridors, and implementation of industrial projects, has a positive impact on the development of the industry. During the period of the program implementation, Kazakhstan has built a Kazakh-Chinese logistics terminal in the port of Lianyungang, a transit highway “Western Europe – Western China” and other facilities. The RK Government has already set goals for the expansion of the “Khorgos” ICBC (International Center for Border Cooperation), while at the same time, it plans to build a large Class “A” food hub, which will provide a place for the collection, storage, and distribution of food products for subsequent export to the Asia-Pacific and Chinese markets. This will increase the center’s throughput capacity and enhance its role in international trade. In addition, the “Burunday Container Terminal” is scheduled to be operational by the end of 2025 – multifunctional container terminal with a total area of 50 thousand sq. m. on a land plot of 16.5 hectares, which will be aimed at storage and processing of imported goods from China and countries of near and far abroad. At the same time, the Government of Kazakhstan has set goals for the construction of cross-border hubs, which will develop the transportation and logistics direction of Kazakhstan. Thus, in 2025 in the West Kazakhstan region there will appear the center of cross-border trade “Eurasia”, which will be focused on cooperation with border regions of Russia and will provide access to the markets of Eastern Europe. The new hub is expected to reach more than 30 million consumers. In 2026, it is planned to create the International Industrial Cooperation Center “Central Asia” in the Turkestan region, the container “Caspian hub” in the Mangistau region, as well as an industrial trade and logistics complex in the Zhambyl region. The International Industrial Cooperation Center will become a key link in strengthening economic ties between Kazakhstan and other Central Asian countries and will also provide access to the market of Afghanistan. The new infrastructure of the industrial cooperation center will reduce logistics costs, speed up the delivery of goods, and stimulate the development of joint productions. “Caspian hub”, in turn, will connect Kazakhstan with Azerbaijan, Turkmenistan, Russia, and Iran, will become an important link in international transportation corridors, and will increase trade turnover with the countries of the Caspian region. The industrial trade and logistics complex will focus on the processing of agricultural products and the development of industrial cooperation between Kazakhstan and Kyrgyzstan; the modern warehouses for storing fruit and vegetable products will become the basis for the development of the region’s agro-industrial complex.

Thus, the interest in foreign capital is reflected in the increasing demand for the purchase and lease of office buildings and warehouses, especially in the major cities of Almaty and Astana. The development of commercial real estate is not limited only to large cities. Regional centers such as Shymkent, Aktobe, and Turkestan show growth prospects due to the development of infrastructure and industrial potential. This opens new opportunities for developers and stimulates investment in both retail and warehouse facilities.

Offices analysis

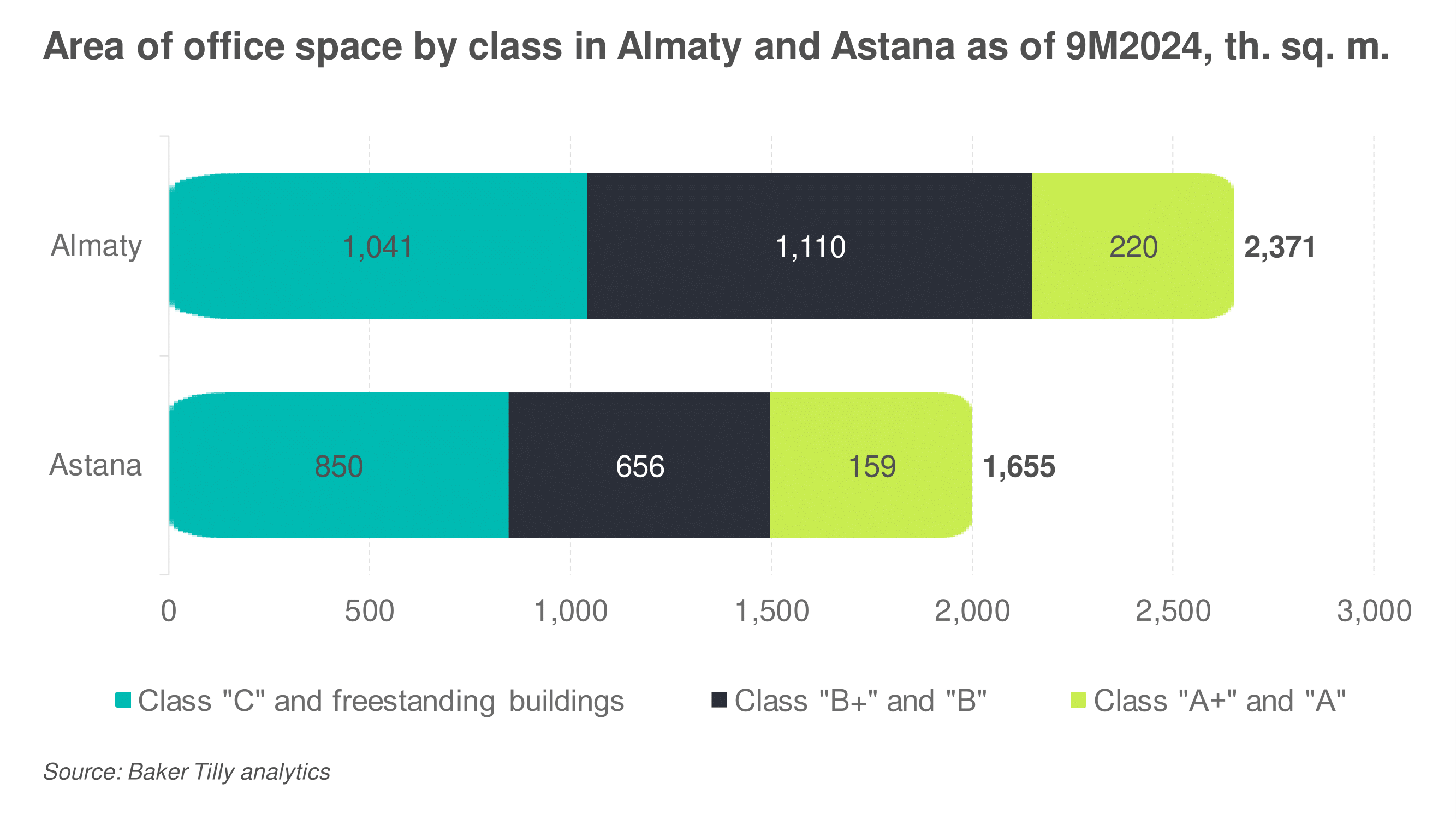

In 2024, the office real estate market in Almaty and Astana still has a high deficit of quality premises. As of the 9 months of 2024, the total office space in Almaty is 2,371 thousand sq. m., where Class “A”/”A+” offices account for 220 thousand sq.m. (9.3% of the total space), Class “B”/”B+” offices – 1,110 thousand sq. m. (46.8%), and Class “C” offices – 1,041 thousand sq. m. (43.9%). As of 9 months of the year, the indicator of office space per 1,000 inhabitants in Almaty city amounted to 1,044 sq.m.

In Astana, the total office area is 1,665 thousand sq. m., where “A”/”A+” Class offices occupy 159 thousand sq. m. (9.5%), “B”/”B+” Class offices – 656 thousand sq. m. (39.4%), and “C” Class offices – 850 thousand sq. m. (51.1%). For the 9 months of 2024, the indicator of office space per 1,000 inhabitants in Astana city amounted to 1,117 sq.m.

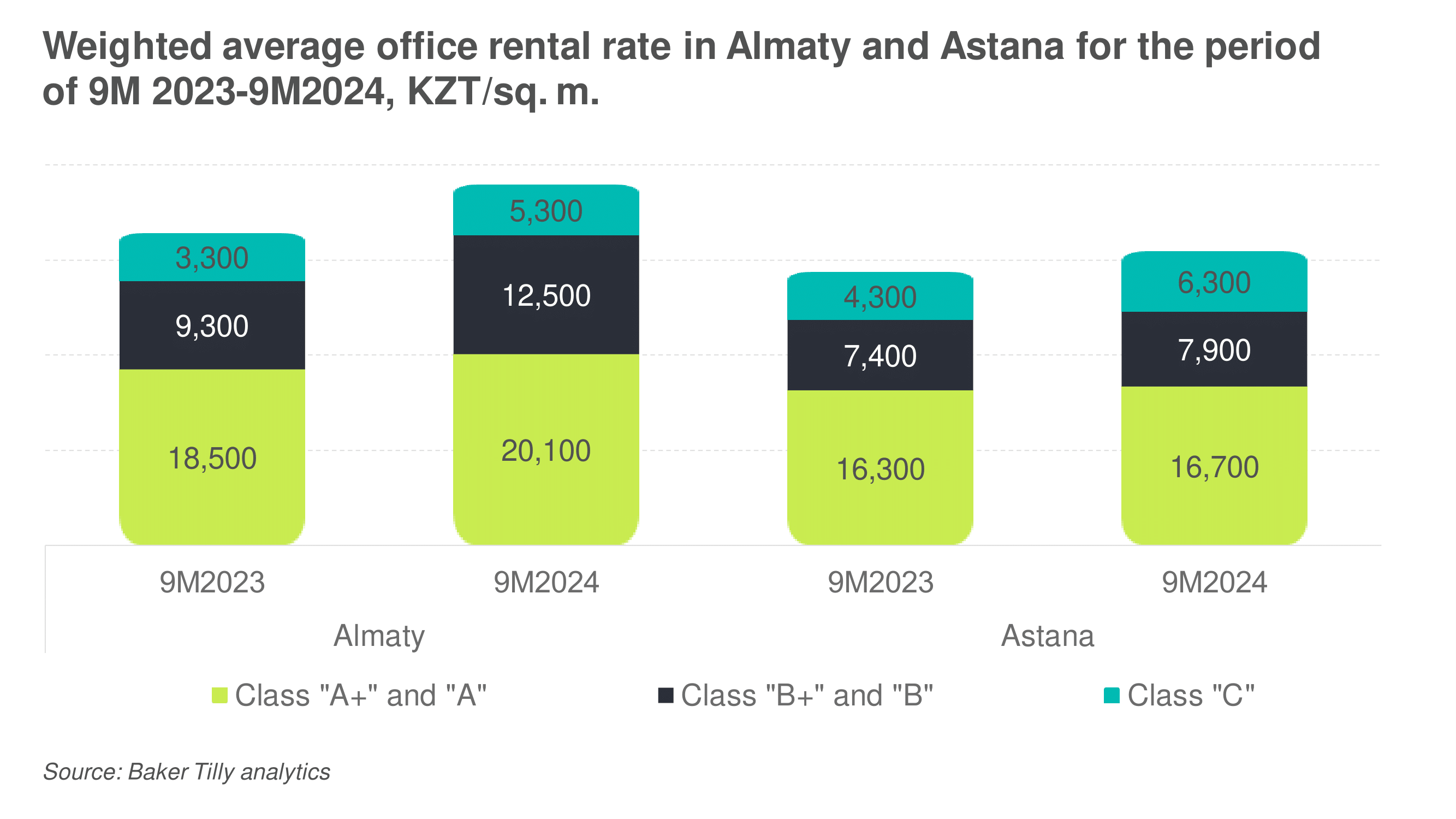

For 9 months of 2024, the weighted average rental rate compared to the same period last year in Almaty is as follows: in Class “A”/”A+” offices the rate showed an increase of 8.6% from 18,500 KZT/sq. m. to 20,100 KZT/sq. m., in Class “B”/”B+” the rate increase is much higher – 34.4%, which is 12,500 KZT/sq. m., while a year earlier offices were rented for 9,300 KZT/sq. m. In Class “B”/”B+” the rate increase is much higher – 34.4%, which is 12,500 KZT/sq. m., while a year earlier offices were rented for 9,300 KZT/sq. m. Over the same period, the weighted average rate for Class “C” offices increased from 3,300 KZT/sq. m. to 5,300 KZT/sq. m., which is 60.6%. It should be noted that the rates presented are calculated considering operating expenses, but not including VAT and utility costs. The main factors of rental rate growth were the low vacancy of vacant premises, growth of operating expenses, as well as the cost of construction.

In 2024, market preferences remain on the side of ready offices with quality renovation and infrastructure. However, due to the low vacancy of Class “A”/”A+” offices, renters are moving to Classes “B”/”B+” and “C”, where they are ready to provide more space at more attractive rates.

In 9 months of 2024, such large business centers as “Nurly Tau” polyfunctional center (10.5 thousand sq. m.) and “Premier” business center (8.5 thousand sq. m.) were commissioned in Almaty. At the same time, large companies prefer to rent or purchase a whole free-standing building before commissioning, as Yandex Kazakhstan did by renting a fully polyfunctional center “Nurly Tau”. During the same period in Astana, the volume of supply on the market did not change. Demand for office space in Classes “A”, and “B” remains high, especially among international companies, which, due to the shortage of supply in the market, are forced to buy or rent separate buildings for offices, as Yandex did. Given the shortage of available space and the low vacancy rate of existing facilities, investing in the construction of quality office premises is a promising direction.

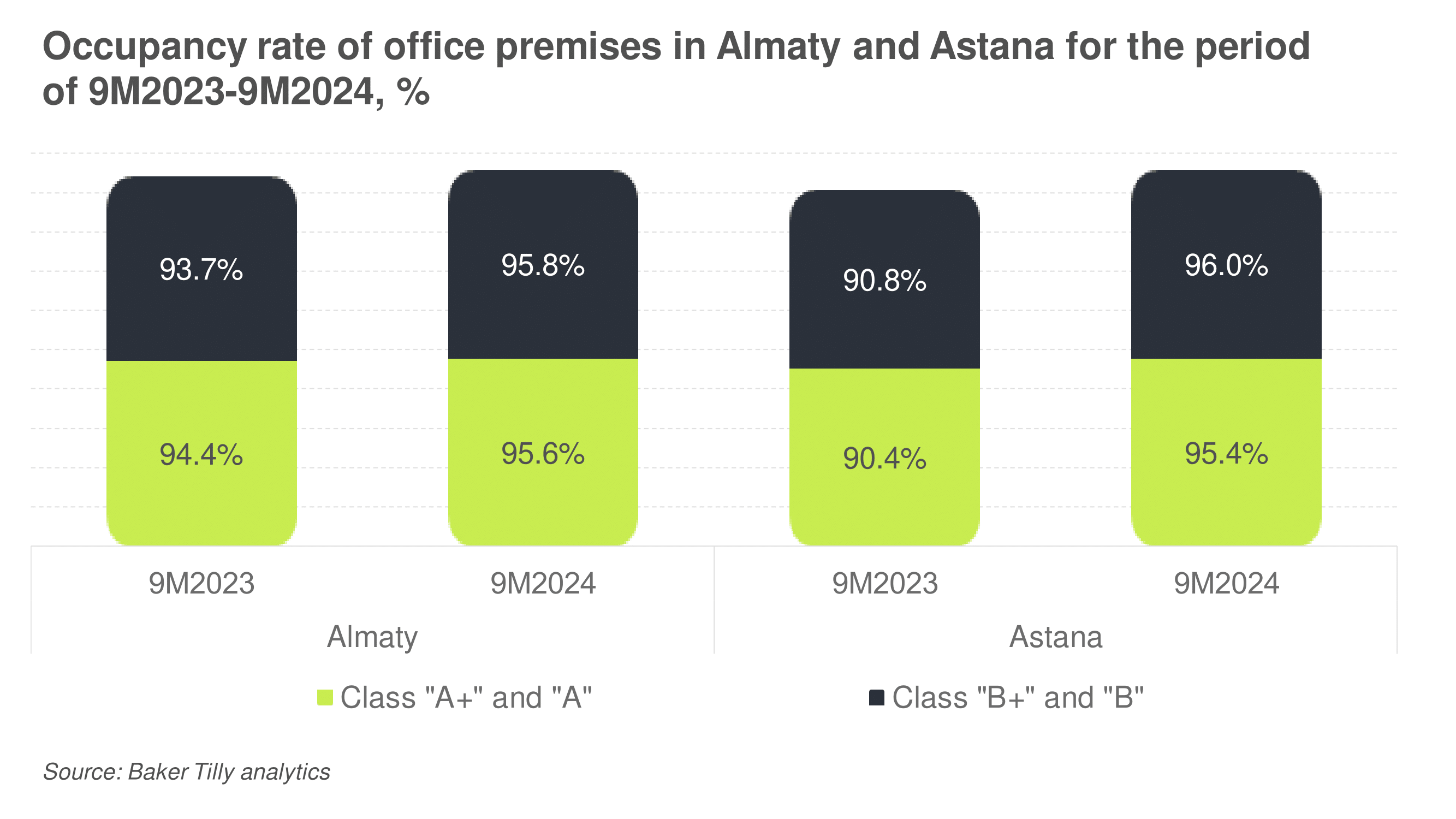

As of the 9 months of 2024, Class “A”/”A+” offices in Almaty are 95.6% occupied and Class “B”/”B+” – 95.8%, while for 9 months of 2023, the occupancy rate for these classes was 94.4% and 93.7% respectively. In Astana, the situation is similar, with the occupancy rate for the “A”/”A+” Class at 95.4% and the “B”/”B+” Class at 96.0%, having increased over the year from 90.4% for the “A”/”A+” Class and 90.8% for the “B”/”B+” Class.

In Almaty by the end of 2024, it is planned to commission 20 thousand new premises for “A” and “B+” classes, including Business Center “Dial Plaza” (8.4 thousand sq. m.) – Class “B+”, Business Center “Element Tower” (6.5 thousand sq. m.) – Class “A”, “Vostochka” (5.2 thousand sq. m.) Class “B+”. However, it will not improve the situation with the lack of available space.

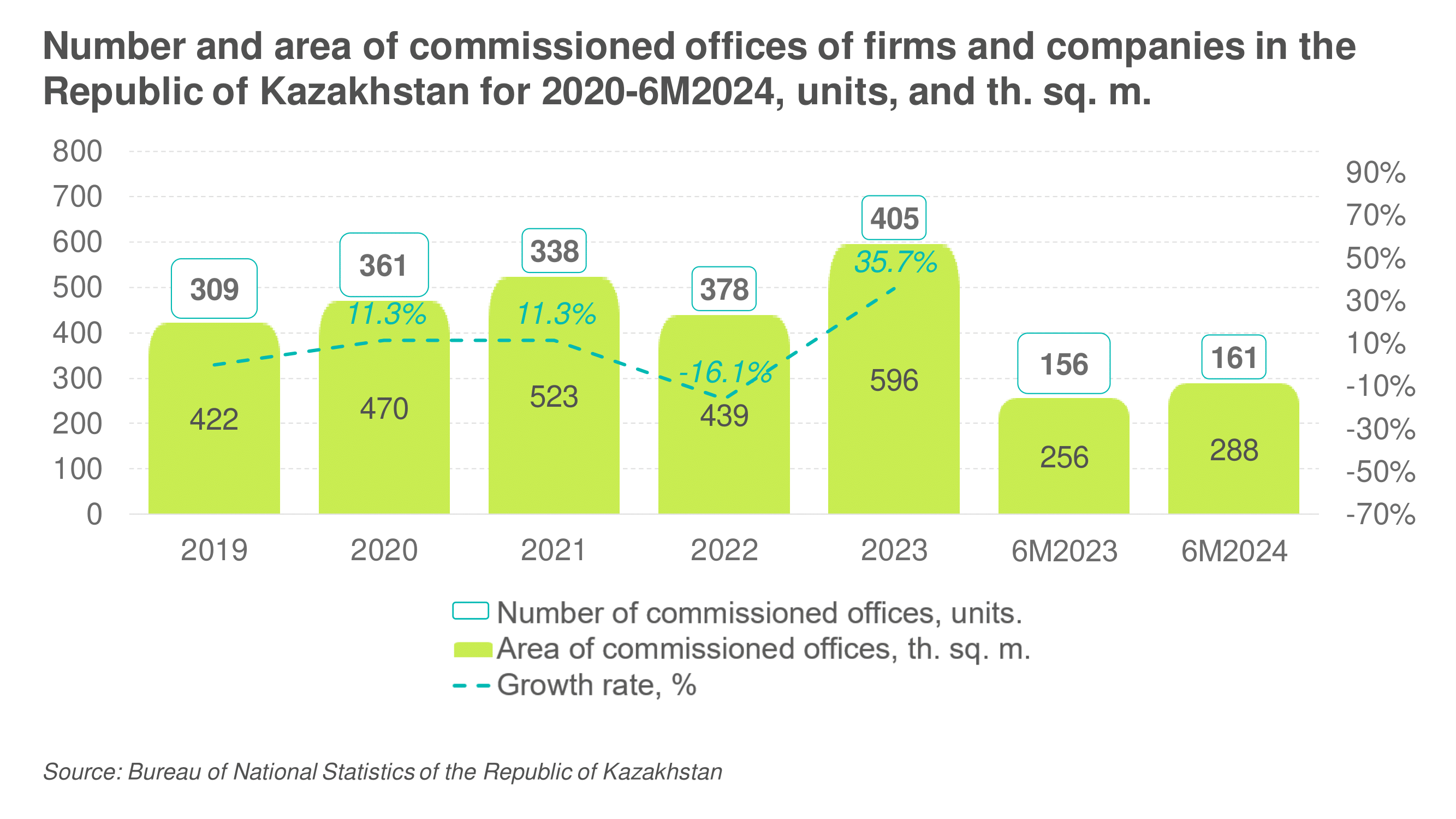

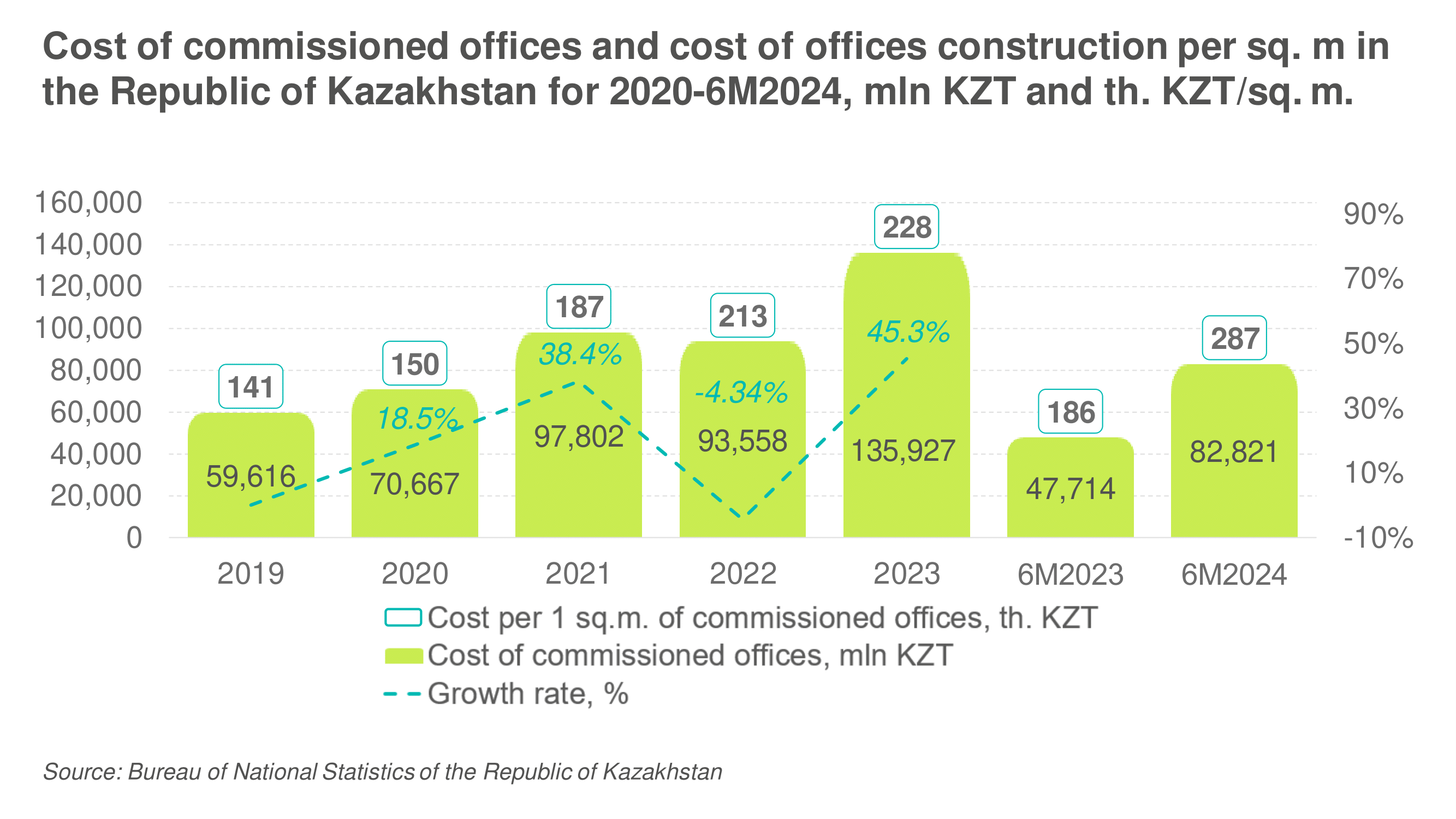

Over 2019-2023, the office real estate market in Kazakhstan demonstrated growth, with the area of commissioned offices increasing from 422 thousand sq. m., and actual value of 59,616 million KZT to 596 thousand sq. m. and a value of commissioned offices worth 93,558 million KZT, according to official statistics. For 6 months of 2024, 288 thousand sq.m. of office real estate objects were commissioned in the country, with a total cost of 82,821 million KZT. At the same time, the cost of construction of offices for 2019 was 141 thousand KZT/sq. m., and at the end of 2023, the cost amounted to 228 thousand KZT/sq. m.

The growth of business activity in the country, and trends to improve infrastructure and working conditions, are reflected in the cost of construction and lead to an increase in rental rates. In the context of business development, the number of international and local companies is increasing, which leads to increased demand for high-class offices that meet the modern conditions of environmental friendliness, as well as technological efficiency. Companies have started to pay more attention to creating a comfortable workplace environment to increase the productivity of employees.

Environmentally sustainable facilities, such as BREEAM (Building Research Establishment Environmental Assessment Method) or LEED (Leadership in Energy and Environmental Design) certified offices with high-quality finishes, a high degree of natural light (insolation), waste sorting and energy saving systems, are becoming increasingly popular. Technologically advanced office space attracts renters with the possibility of creating an efficient working environment that allows for the introduction of hybrid work formats.

Warehouses analysis

The current economic situation in the country contributes to the active development of the warehouse real estate industry. The rapid growth of the industry is due to the increase in foreign trade volumes, expansion of transit traffic, and development of the e-commerce market.

The volume of warehouse rental and management services provided for 2023 amounted to a record 79.5 billion KZT, showing an increase of 96.8% by the end of 2022. For the period 2019-2023, the volume of services provided in the industry increased by 45.1%.

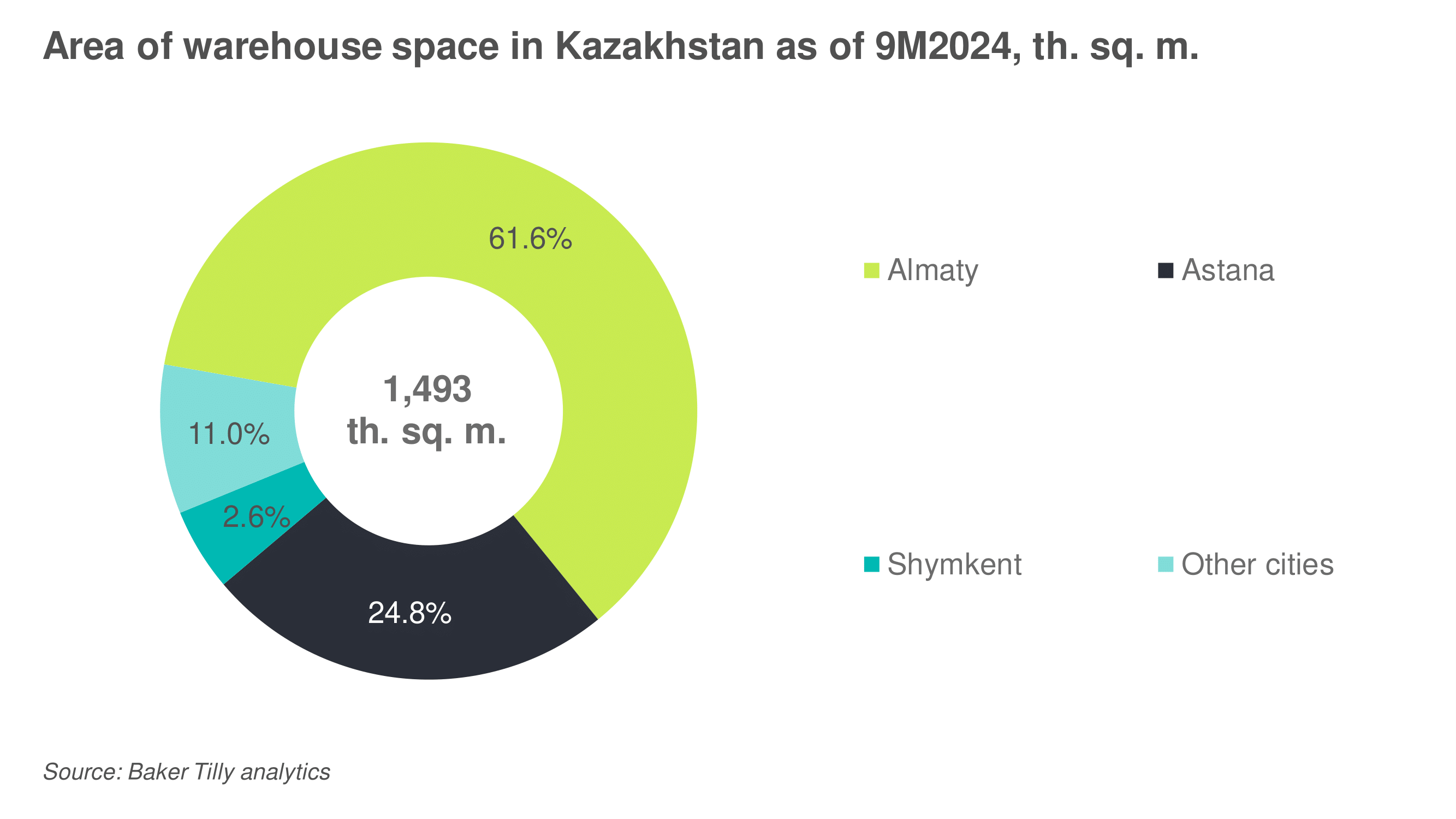

The total area of quality warehouses (Classes “A” and “B”) for 9 months of 2024 is 1,493 thousand sq. m. Class “A” warehouses account for 75.5% of the total area – 1,128 thousand sq. m., while Class “B” warehouses account for 365 thousand sq. m. (24.5%).

As for the distribution by regions, the leader in terms of the total area of quality warehouses is Almaty – 919 thousand sq. m. (61.6%), Astana – 370 thousand sq. m. (24.8%) and Shymkent – 40 thousand sq. m. (2.6%), the share of other cities and regions is 164 thousand sq. m. (11.0%).

Availability of quality warehouses (Classes “A” and “B”) per 1,000 people as of 9 months of 2024 is at the level of 7.4 sq. m. According to this indicator, Kazakhstan is behind many developed countries, while the indicator of provision of warehouses of Classes “A” and “B” in the Russian Federation is 30 sq. m. Vacancy of warehouses was 3.7% for Almaty and 8.1% for Astana.

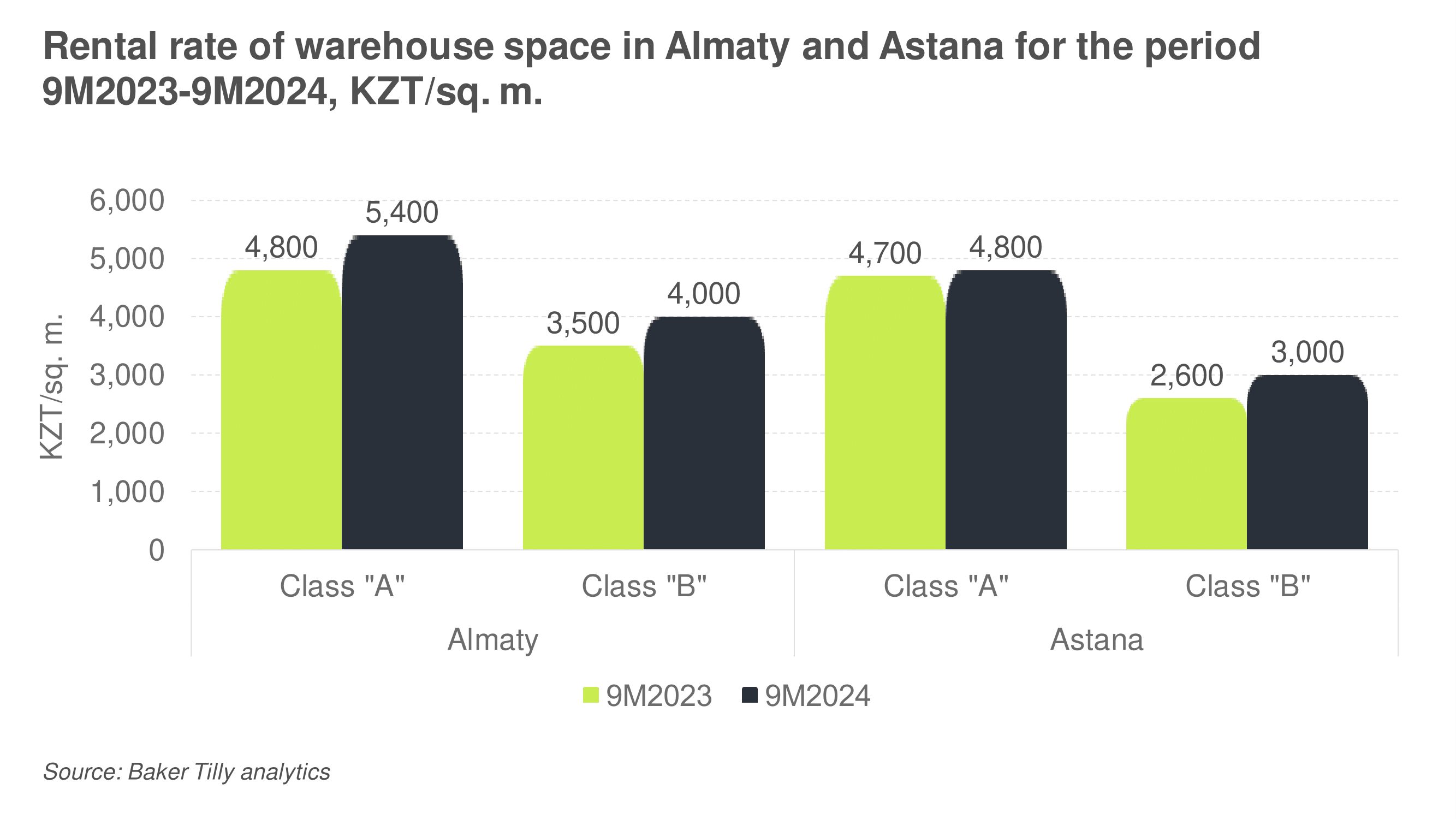

The weighted average rental rate for Class “A” warehouse as of 9 months of 2024 excluding VAT, operating, and utility costs in Almaty is 5,400 KZT/sq. m. per month, in Astana, the rental rate is 4,800 KZT/sq. m., the increase in rental rate compared to the same period of 2023 amounted to 12.5% for Almaty and 2.1% for Astana. Class “B” rental rate in Almaty is 4,000 KZT/sq. m., having increased by 14.3% (from 3,500 KZT/sq. m.) by 9 months of 2023, in Astana the rate increase amounted to 15.4%, from 2,600 KZT/sq. m. to 3,000 KZT/sq. m. as of 9 months of 2024.

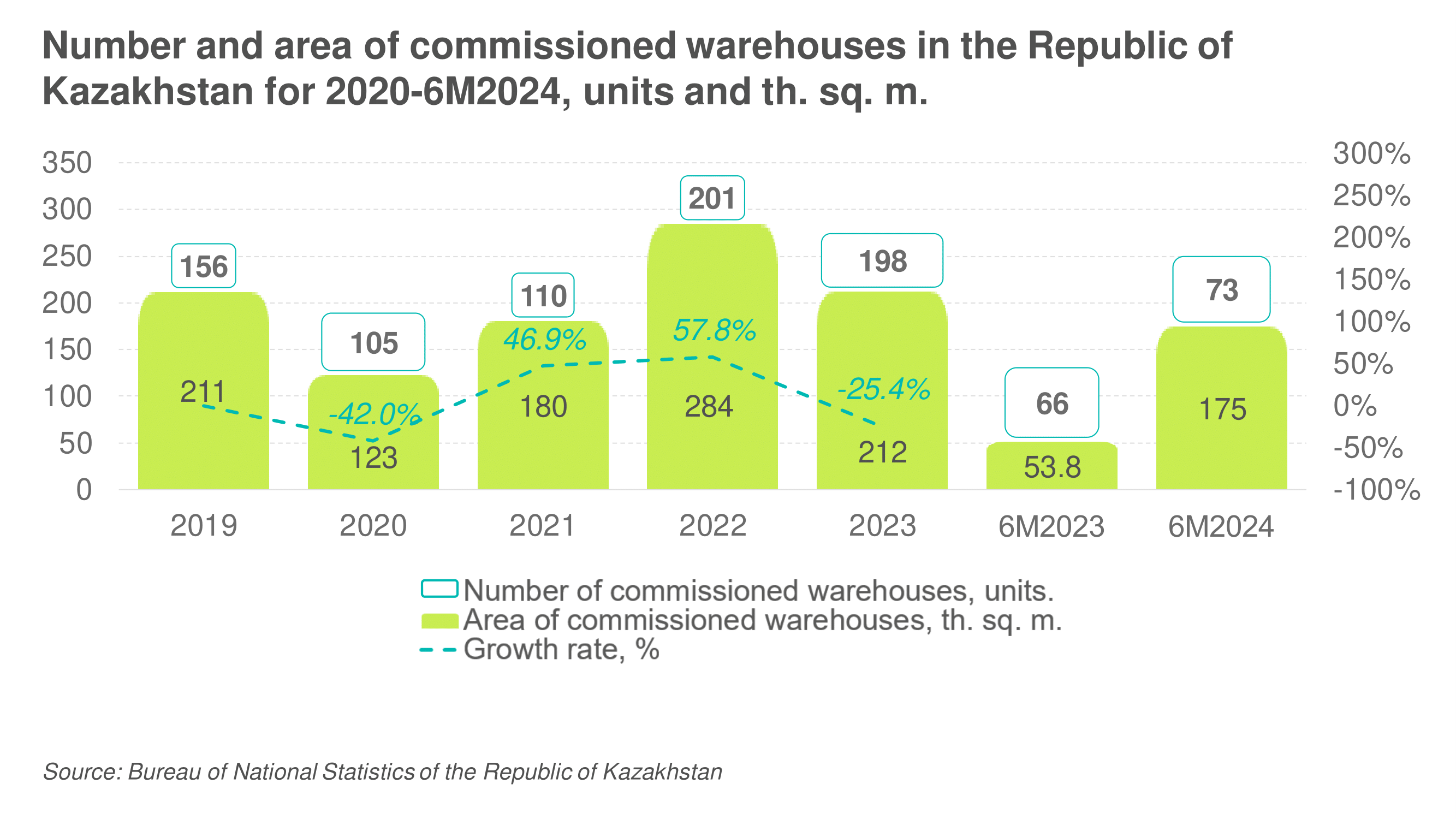

At the same time, there is a positive dynamic of warehouse construction in the country. According to the Bureau of National Statistics of the Republic of Kazakhstan, for 6 months of 2024, 73 warehouses with a total area of 175 thousand sq. m. of warehouses were commissioned, while for the same period of 2023, 66 warehouses with an area of 51.2 thousand sq. m. were commissioned. It is worth noting a sharp increase in the number of commissioned warehouses in 2022, in which 201 objects were commissioned, with an increase of area of about 73.8% compared to 2021 from 180 thousand sq. m. to 284 thousand sq. m., which is due to the construction of a large transport and logistics center QazCon Hub in Almaty region.

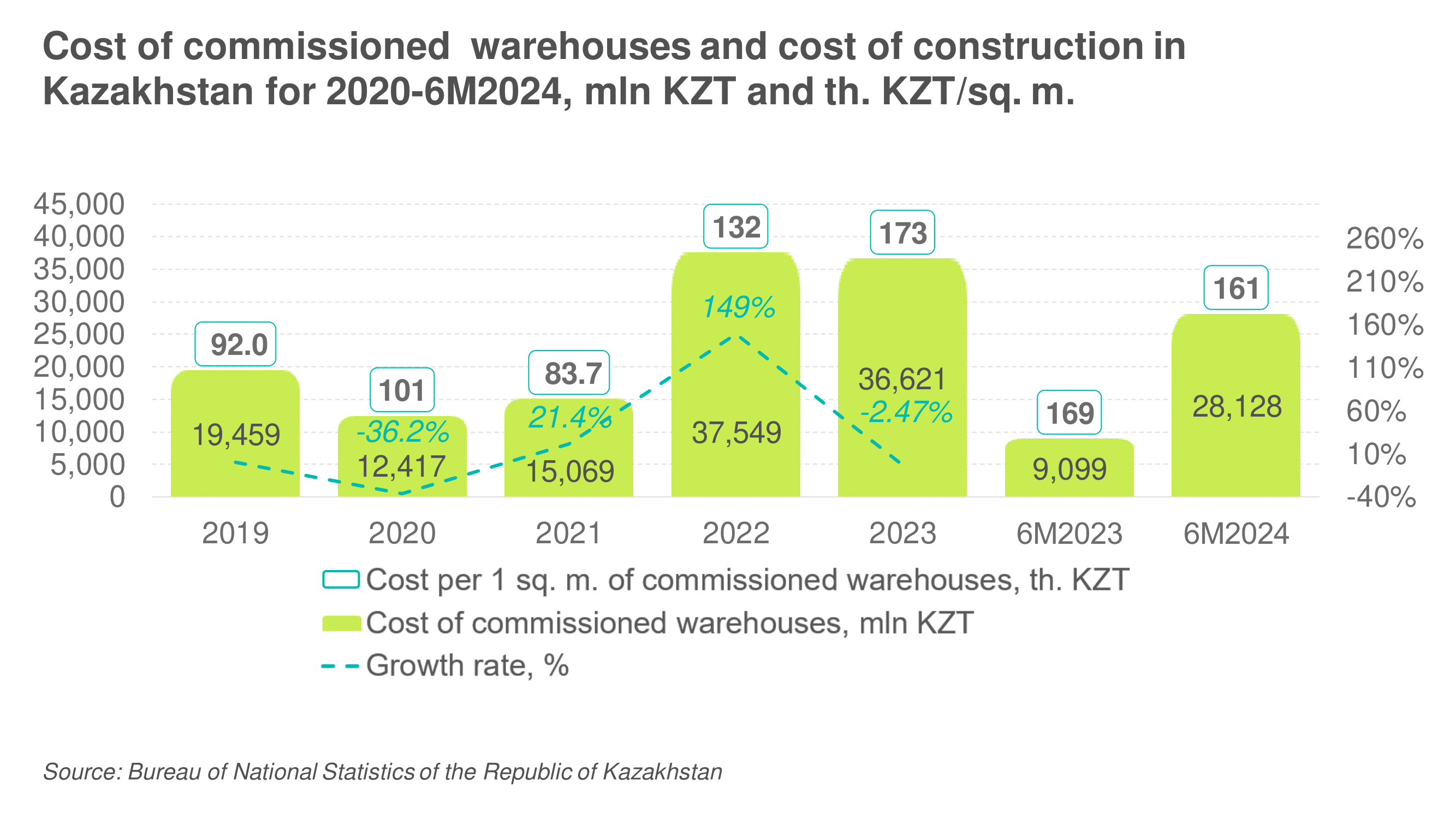

For 6 months of 2024, objects with a value of 28,128 million KZT were commissioned, and the construction cost per sq. m. amounted to 161 thousand KZT. In 2023 the amount of construction works was equal to 36,621 million KZT, which is 2.5% less than in 2022 (37,549 million KZT) but 149% more than in 2021 (15,069 million KZT). However, the construction cost per sq. m. increased from 132 thousand KZT in 2022 to 173 thousand KZT in 2023. Thus, for 2019-2023, the cost of commissioned warehouses increased by 87.7%, from 92.0 thousand KZT/q. m to 173 thousand KZT/sq. m., while according to statistical data, prices in construction increased by 15.0%. Over 2022-2023, there was a tendency for the growth in the value of actually commissioned warehouses to outpace construction price indices. These market trends reflect the increased interest in high-quality Class “A” and “B” facilities, which tend to focus on warehouse technologies: ceiling height, building capacity, automation systems, and climate control, which increase the overall cost of design and construction. There is also a tendency in the country to build large logistics hubs, and as a rule, the construction of these facilities increases the cost of the facility by additional investments in infrastructure and transportation.

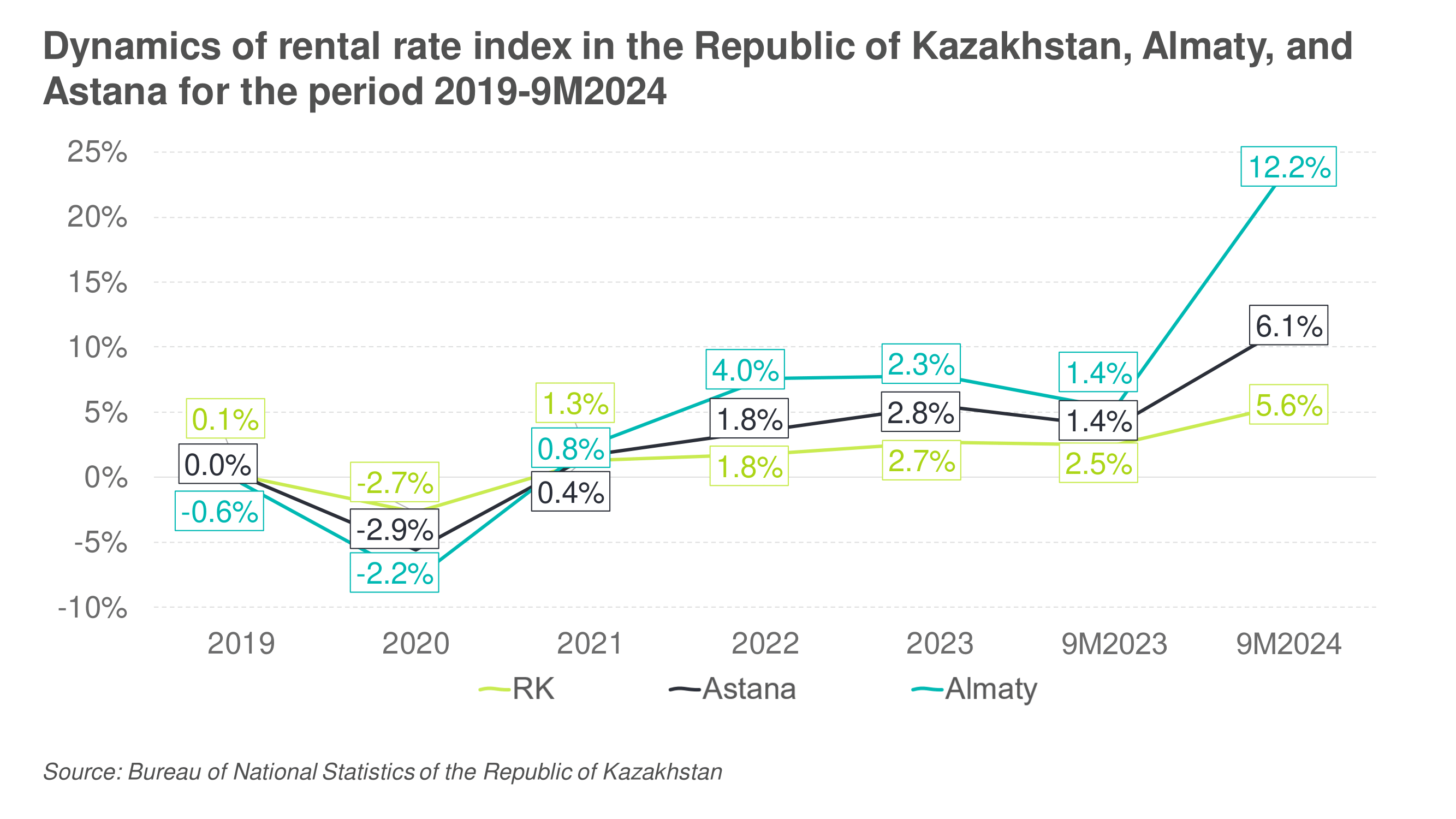

According to the Bureau of National Statistics, the increase in the rental rate for warehouses in Astana for 2023 compared to the results of 2022 amounted to 2.8%, for Almaty the increase amounted to 2.3%, while for Kazakhstan it was equal to 2.7%. For the 9 months of 2024, the national rental rate increased by 5.6%, while for Astana and Almaty, the increase amounted to 6.1% and 12.2%, respectively. The largest rate increase was for Class “A” warehouses in Almaty and Class “B” warehouses in Astana, due to low vacancy rates in these segments. In the regions, rate growth was observed in the north of the country: in the Karaganda and Akmola regions, which is a consequence of floods at the beginning of 2024.

The development of e-commerce leads to the fact that more and more companies are investing in the construction of new warehouses, as evidenced by the structure of commissioned facilities. According to the results of 2023, the largest commissioned facilities were the “OZON” fulfillment center in Astana (38 thousand sq. m.) and the “Spark” fulfillment center in Almaty (30.5 thousand sq. m.). In 2024, 174 thousand sq. m. of warehouses were commissioned, including warehouse “Technodom Astana” (28 thousand sq. m.) and warehouses “Damiani Property Management” (40 thousand sq. m.).

In 2025, a warehouse for “Wildberries” (100 thousand sq. m.) and “Ozon” (42 thousand sq. m.) in Almaty and Almaty region, a warehouse for “Wildberries” (166 thousand sq. m.) in Astana, warehouse complexes of “Kazpost” in Aktobe are announced for commissioning.

In addition, one of China’s largest logistics companies, “YTO Express Co”, has launched a joint venture with “Kazpost” JSC focused on postal delivery of e-commerce products. “YTO Express Co” plans to build in Kazakhstan its large distribution center for e-commerce products for the entire Central Asian region.

Thus, given the growth rate of e-commerce in trade, as well as the potential of Kazakhstan as a logistics hub for the whole of Central Asia, the largest of the warehouses planned for construction are full-fledged fulfillment centers or provide 3PL services for e-commerce, which reflects the readiness of marketplaces and other e-commerce players to invest in their warehousing capacity.

Retail premises analysis

Over the last ten years, retail real estate in Kazakhstan has undergone significant changes, reflected both in the area of commissioned shopping and entertainment centers (SECs) and in the dynamics of their development. Despite the growth of online sales and e-commerce, the volume of traditional trade remains stable. Kazakhstani shoppers still prefer the “offline” format of shopping. In addition, visiting shopping malls is part of cultural leisure, which contributes to maintaining high attendance.

The dynamics of the volume of services provided in shopping centers and malls for the period 2020-2023 show a positive trend, with the peak being reached in 2022, amounting to 409 billion KZT. However, in the first half of 2024, volumes were significantly lower, amounting to 64.0 billion KZT, which is 52.7% less than in the same period in 2023 (135.5 billion KZT). An important factor behind the decline in volumes in the market is the growth of e-commerce. In Kazakhstan, from 2013-2023, the share of e-commerce in the trade structure increased from 0.7% to 12.2%.

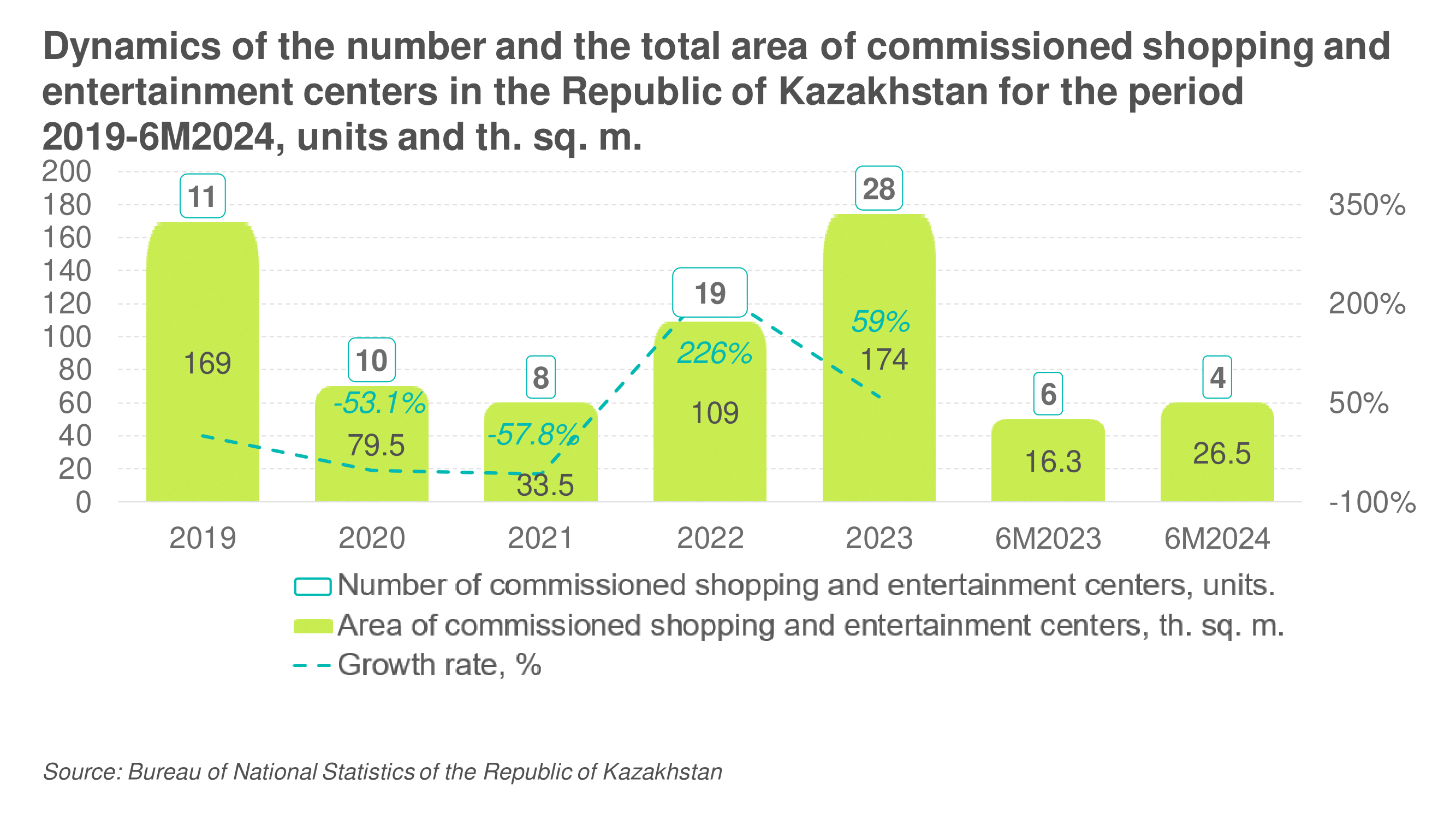

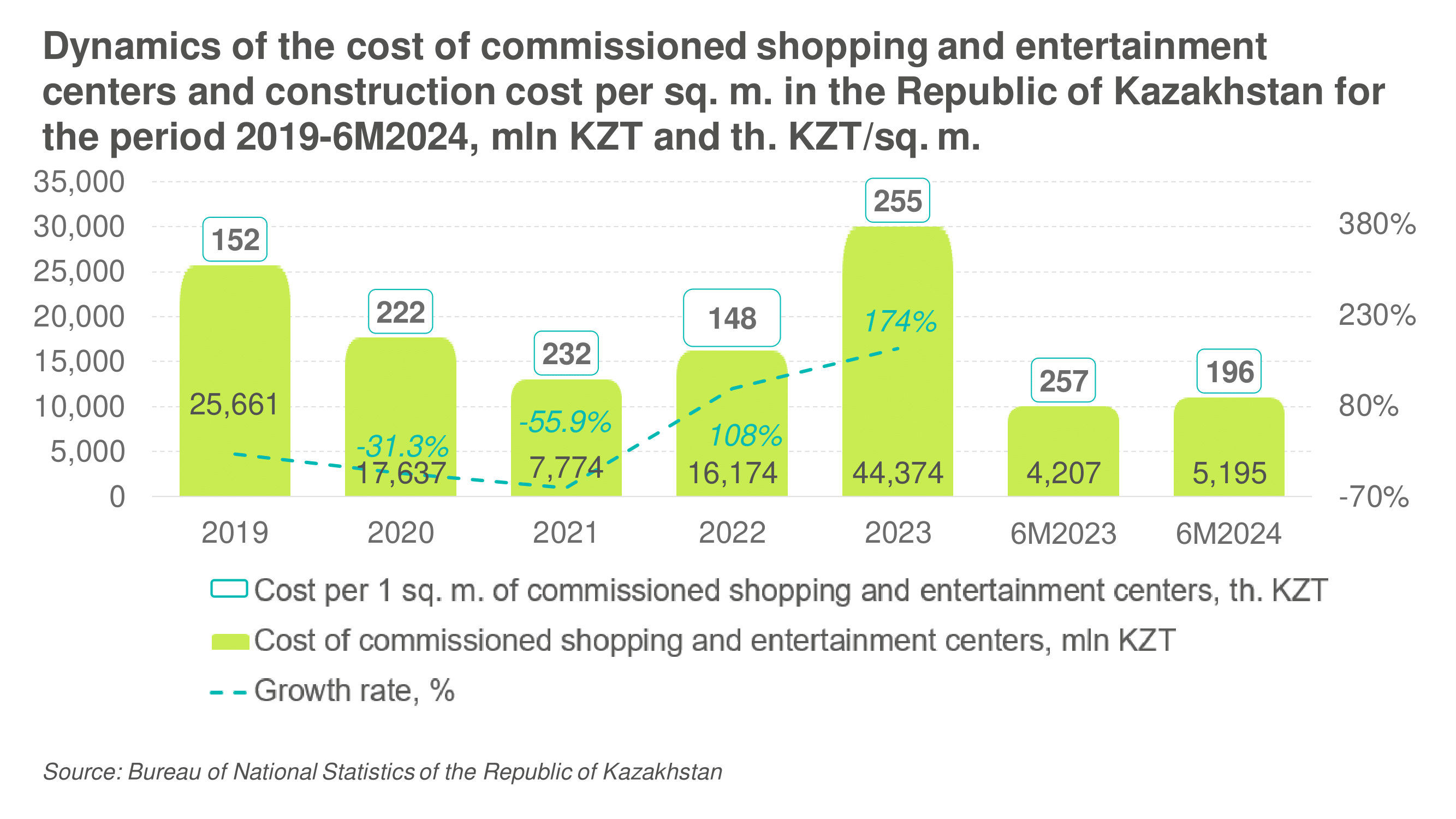

According to the RK Bureau of National Statistics, in the period from 2019 to 2023 there were unstable dynamics of commissioning of shopping and entertainment centers, reaching the highest in 2019, in which 11 facilities with a total area of 169 thousand sq. m. were built, and then experiencing a significant decline in 2020 and 2021 due to the imposed quarantine restrictions. However, from 2022 to 2023, there was impressive growth in the area of commissioned shopping and entertainment centers, which amounted to 109 thousand and 174 thousand sq. m. respectively. Of particular importance for modern retail space in Almaty was the year 2023, at the end of which 28 objects were commissioned such as “Aport Mall East” in Almaty with a total area of 150 thousand sq. m. In 2024, “Infinity Mall” was opened in Atyrau with a total area of more than 50 thousand sq. m., as well as two facilities in Shymkent with a total area of 25 thousand sq. m., one of which is “Shymkent City Mall”, commissioned in the second quarter of 2024. During the same period, two objects in the Kyzylorda region with a total area of 1.4 thousand sq. m. were built. It should be noted that the cost of commissioned shopping and entertainment centers for 2019-2023 increased by 68.3%, from 152 thousand KZT/sq. m. to 255 thousand KZT/sq. m., which is due to the increase in prices for imported materials.

As for the prospects of commercial real estate development in the regions, the retail market also has potential for growth. Shopping centers and malls in regional centers will develop at a slower pace than in Almaty and Astana, but active development of the regions can already be observed.

For 2021-2023 in the regions of the country 206 thousand sq. m. of retail real estate were built, the peak of construction was in 2022 – 109 thousand sq. m. For the same period in Almaty 110 thousand sq. m. were commissioned.

E-commerce, despite its annual growth, cannot fully replace traditional commerce, the disadvantages of online shopping are still delays in delivery and the risk of receiving goods of improper quality.

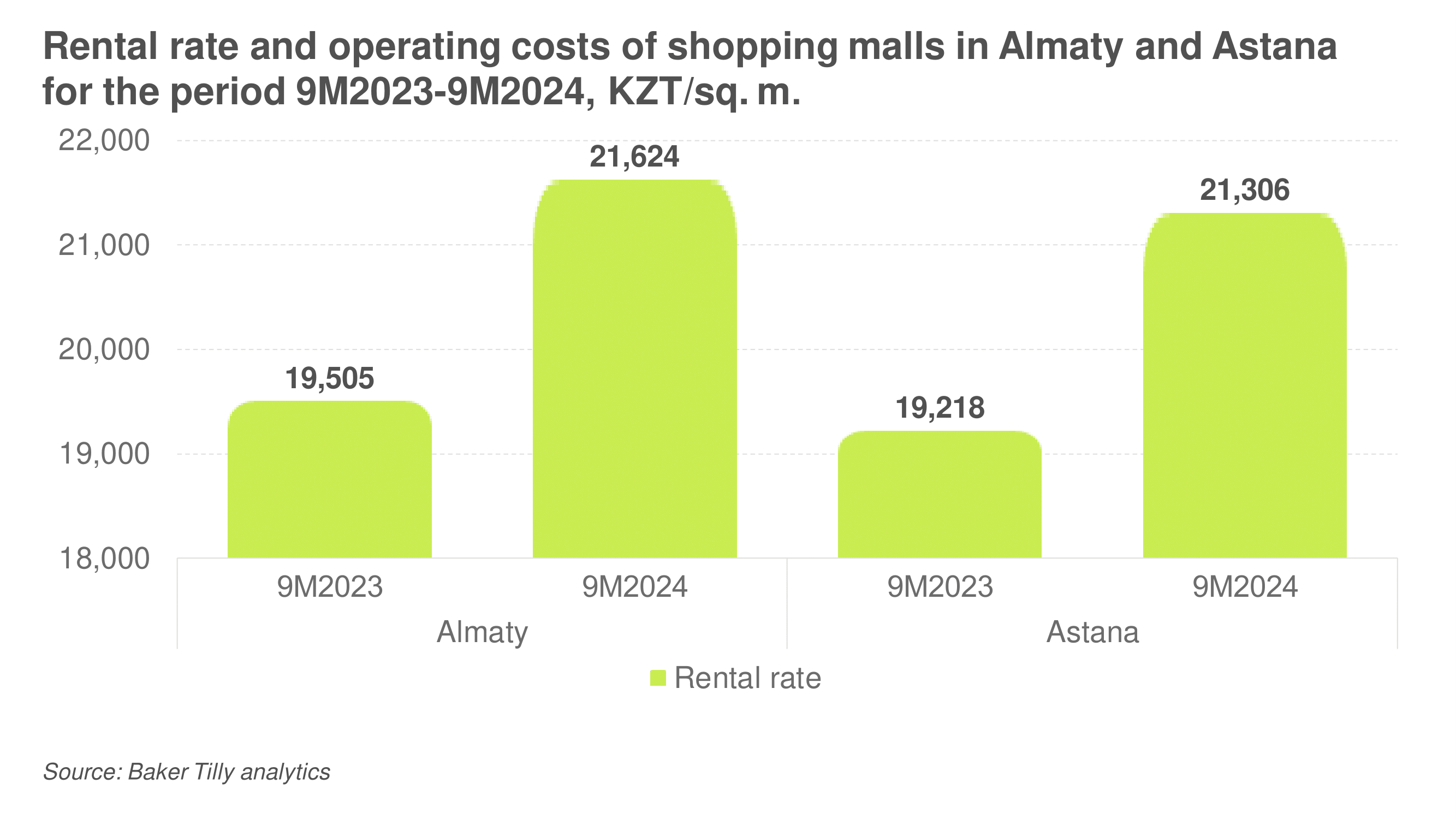

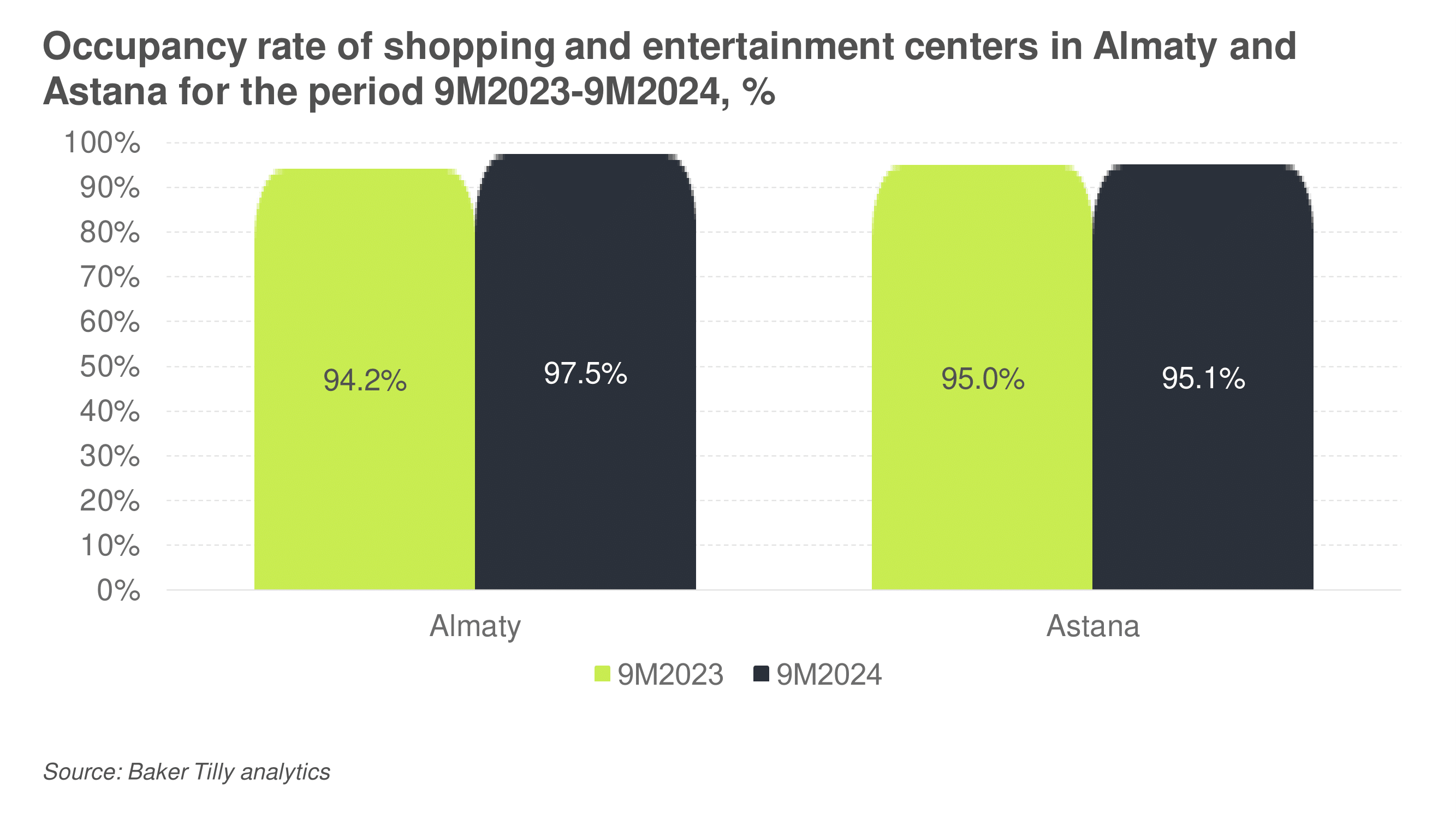

The vacancy of retail space in Almaty and Astana remains extremely low, and the average occupancy rate of SECs is over 95% (97.5% in Almaty and 95.1% in Astana). This indicates that even with the decline in the volume of services provided in shopping centers and malls, the demand for quality retail space is not decreasing. Businesses continue to choose modern shopping malls, which emphasize the steady demand for offline shopping formats. The weighted average rental rate in Almaty as of 9 months of 2024 was 21,624 KZT/sq. m. excluding operating expenses, while a year earlier the rate was 19,505 KZT/sq. m. In Astana, weighted average rates for similar areas are 21,306 KZT/sq. m., up from 19,218 KZT/sq. m. Average operating costs in Almaty for 9 months of 2024 are 3,473 KZT/sq. m. and in Astana – 2,350 KZT/sq. m. respectively, which is due to the fact that most of the malls in Astana are newly commissioned, which implies lower maintenance costs due to the lack of significant maintenance and modernization costs.

The market for retail premises – SECs, and shopping malls, will continue to develop and adapt to the challenges of time, maintaining a stable demand for quality and convenient spaces, despite changes in consumer preferences.

It should be noted that the earthquake in Almaty, which occurred at the beginning of 2024, did not have a long-term negative impact on the market, which is proved by the growing volume of rendered services in real estate transactions – the volume of sales and purchase transactions, as well as the volume of rental and maintenance of premises. For 6 months of 2024, the volume of rendered services in real estate transactions amounted to 350 billion KZT, showing a growth of 13% compared to last year (310 billion KZT). The effects of natural factors had the greatest impact on the housing market, where the greatest increase in activity was seen in the purchase and sale of residential real estate, the volume of which grew significantly over the same period last year, from 3.7 billion KZT to 20.8 billion KZT. The growth in the volume of purchase and sale of residential real estate was due to an increase in the number of transactions, particularly in apartment buildings. As for commercial real estate, the volume of services provided continues to increase in Almaty, with the volume of office, warehouse, and retail space rental and management services totaling 94.1 billion KZT in 6 months of 2024, 74.4% up compared to the previous year (54.0 billion KZT).

Floods in the central and northern regions also had an impact on the housing market and only a limited impact on the office real estate market. Despite a temporary decline in business activity at the beginning of the year, the housing market recovered quickly due to government programs, and property business losses were partially restored at the expense of the state and local budgets.

Thus, the natural factors that occurred in the country in 2024 did not affect the plans of investors in investing in commercial real estate. The shortage of quality premises and rental rate growth is observed in every segment of commercial real estate, which is a positive signal of market entry and the main factor of the attractiveness of investments in the industry.

In the coming years, the commercial real estate market in Kazakhstan can expect continued growth in demand for commercial real estate for office, warehouse, and retail premises. Among the main trends these can be highlighted:

- Growth of demand for multifunctional complexes that include office, retail, and residential real estate. Renters are increasingly favoring premises that provide the infrastructure that allows them to maintain a “Life-work balance”.

- Increasing trend towards environmental friendliness and energy efficiency of facilities. Many international companies investing in commercial real estate are interested in the compliance of properties with environmental standards such as LEED and BREEAM. Renters are becoming more conscious of resource consumption and reducing negative environmental impacts, and more sustainable materials are being used in the architectural design of buildings.

- The market share of e-commerce and sales through marketplaces will continue to increase. The construction of logistics hubs in the border territory with China will increase the flow of Chinese products to Kazakhstan. “Pinduoduo’, ”1688”, “Temu” and the parent company of Alibaba’s online store “YTO Express Co” are actively entering the market.

- The growth of the e-commerce market and growth of trade with China are driving the construction of fulfillment centers and “last mile warehouses”. These facilities ensure a reduction of delivery times to end users, thus ensuring customer satisfaction. Given the low level of per capita warehouse development, investment in warehouses with developed transportation infrastructure, as well as the provision of 3PL services, is becoming an important area of commercial real estate development.

- Outside Almaty and Astana, the commercial real estate market has growth prospects, especially in regions with developing infrastructure and industrial zones. Construction and installation work of transport and logistics centers are underway in Almaty region, Shymkent, Turkestan, and West-Kazakhstan regions, with a planned launch date of 2024-2025. In addition, in 2025, a large shopping mall “Aktau Mall” is planned to open soon in Aktau, in Ust-Kamenogorsk “Max Mall” is under construction, with a total leasable area (GLA) of 33 thousand sq. m. Construction of shopping and entertainment centers in North Kazakhstan and Ulytau regions is planned for 2026-2027.

Thus, the trends reflect the steady development of the commercial real estate market in Kazakhstan and emphasize the attractiveness of investments both in major cities and in the regions.

Authors: Ramina Nazyrova, Valuation Partner; Kamila Khilanova, Valuation Manager; Akbota Maratova, Senior Valuation Consultant